- The IOTA price drops 6% to flip the $1.80 support into resistance.

- MIOTA could drop below the $1.60 level towards the $1.54 support wall.

- IOTA’s upswing depends on crucial support at the $1.54 demands zone.

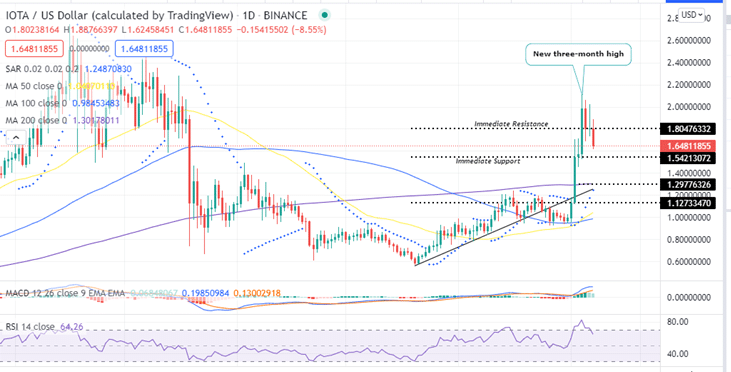

IOTA (MIOTA) rallied approximately 120% from $0.96 on September 01 rising above the June 03 range high at $1.48. This rally saw IOTA reach a new three-month high above $2.11 on September 04. This upward rally has seen the RSI move into the overbought region going beyond 84 on September 04.

After consolidating between $1.68 and $2.05 over the last two days, IOTA tanked below the recently established support at $1.80 earlier today as it struggles to hold above $1.60.

IOTA Price Upward Movement Depends On The $1.54 Crucial support

The IOTA price prediction is significantly bearish in the short-term. At the time of writing, MIOTA is trading in the red at $1.648 as bears remain focused on taking it below $1.60. Realise that a drop below this this point could take the IOTA price to seek refuge at the $1.54 support wall.

This support zone is crucial to MIOTA restarting the uptrend counting that the asset has successfully held above this area in the past, at the end of March and the beginning of April, and recently on September 03 and 04. Note that a strong rebound off this support wall could be a suggestion that the bulls were regrouping as they bought in on the minor dips.

IOTA/USD Daily Chart

Note that MIOTA’s bearish outlook is validated by the nose-diving Relative Strength Index (RSI) indicator away from the overbought zone. This is a clear indication that the bears are currently in control of IOTA.

If IOTA continues to favor the bears and the support at $1.54 fails to hold, MIOTA could tank below the $1.40 level to re-visit the 200-day Simple Moving Average (SMA), the 50-day SMA and the 100-day SMA at $1.29, $1.03 and $0.98 respectively.

On the flipside, if MIOTA favors the bulls and makes a strong rebound off the crucial support wall a $1.54, IOTA bulls could be bolstered to overcome the immediate provided by the $1.80 psychological level. If this happens, MIOTA price may revisit the September 04 high above $2.11 with the May 16 range high at $2.27 in the offing.

The upsloping moving averages, the positive Parabolic SAR and the bullish Moving Average Convergence Divergence (MACD) indicator accentuate this bullish bias. Note that the MACD line (the 12-day exponential moving average (EMA)) crossed over the signal line (the 26-day SMA) on September 01, sending a bullish crypto signal. The MACD has remained bullish since then. As long as this trend-following indicator remains above the signal line and continues to move above the zero line in the positive zone, IOTA will remain bullish.

Where to Buy MIOTA Cheap Now

If you want to trade IOTA, you can do so on the following on eToro. eToro is one of the most trusted exchange platforms in the crypto space. eToro supports copy trading, which allows new traders to learn from market experts. eToro also charges low trading fees and commissions.

Looking to buy or trade MIOTA now? Invest at eToro!

Capital at risk