- Gold prices moved away from a two-month low for the second straight day.

- Following the FOMC meeting, the US dollar extended its corrective decline and supported commodities.

- Risk sentiment can deter bulls from aggressive betting and limit profit potential.

On Thursday, the gold price rebounded from the $1,753 area, or the two-month low, after the previous day’s rebound after the FOMC meeting. During the European session, spot prices moved into the $1,786 area for the second consecutive day.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

Keeping its interest rate unchanged at 0.25%, the US Federal Reserve announced that it would double the rate cut to $30 billion per month. As a result, according to the so-called scatter plot, federal funds rates are expected to triple in the next year. However, the markets have already factored in the possibility of faster Fed tightening. As a result, dollar-denominated commodities, including gold, benefited from the sharp drop in the US dollar from a 16-month high.

The rapid proliferation of the new Omicron variant and new economic restrictions in Europe and Asia have further fueled the safe haven of XAU/USD. Nevertheless, the generally positive tone in equity markets could deter traders from aggressive bull prices and curb further gold gains.

The US economy is now awaiting the release of the first weekly unemployment claims, the Philadelphia Fed Manufacturing Index, industrial production, and the PMI short-circuit index. Combined with some volatility caused by the monetary policy decision of the Bank of England/ECB, this should give commodities some momentum.

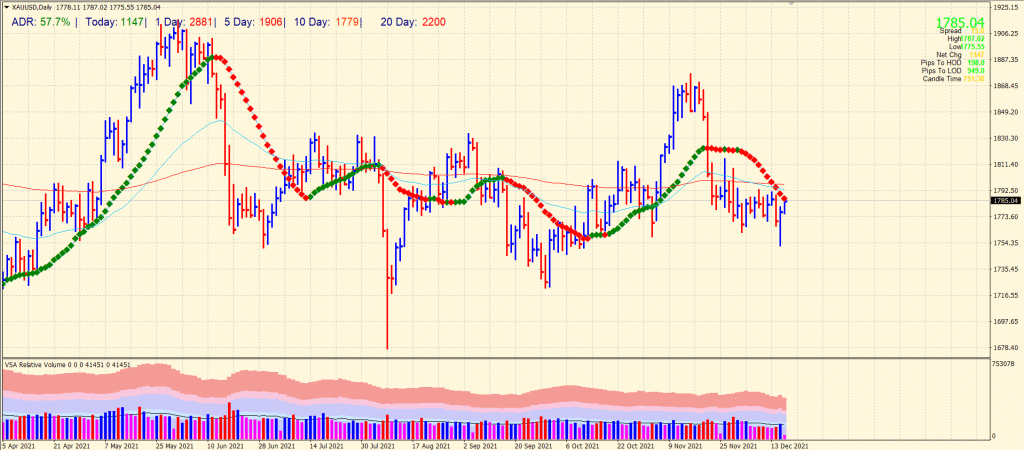

Gold price technical analysis: Bulls eying $1,800

The 200-day SMA will likely act as stiff resistance for any subsequent bullish move. The $1,795 barrier coincides with the 100-day SMA. Strength beyond the merger obstacle should pave the way for further short-term gains. Gold could then accelerate towards medium resistance near $ 1812-15 before rallying to test the $ 1832-34 supply zone.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

A significant pullback now appears to find reasonable support around the $ 1,770 level. In the event of a subsequent sell-off, XAU/USD could fall back to USD 1,753, which would be a new trigger for bearish trades if a breakout occurs. The next significant support is near the $ 1726-25 area, below which the price of gold could test $ 1700.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.