- While risk aversion is still prevalent, gold prices have recently accepted recent highs.

- Despite a more robust scatter chart, returns respond to central bank action and concerns about a delay in the Fed’s rate hike.

- A busy week ends with virus updates and geopolitics at the forefront.

The gold price (XAU/USD) is seeking to reach its monthly high of $1,805, up 0.39% for the day, in anticipation of Europe’s biggest weekly jump in six months early Friday morning.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

The gold price is being encouraged by disappointing US Treasury bond yields and good news from India, the world’s largest gold buyer. Moreover, gold buyers have benefited from futures market data, which shows that the Fed’s rate hike has lagged behind what was promised in the previous chart.

Meanwhile, US Treasury bond yields are falling for the second day in a row, weighing on the US Dollar Index (DXY), which dropped 0.05% to 95.85.

According to Reuters, the Indian Commerce Department has provided an update via NewsRise regarding the government’s proposal to lower the gold import tariff from 7.5% to 4.0%.

A Financial Times (FT) article cited futures data that indicated market rates for an upcoming Fed rate increase. Traders in the futures market say the Fed’s overnight rate will rise by the end of the year, which indicates how investors are positioning themselves for changes in Fed rate policy in the coming years. 1.27% will rise by the end of the year, FT reported. However, the article added, “This is a full 0.11 percentage points below Wednesday’s 1.38% forecast, compared to the Fed’s 1.6% forecast released yesterday.”

Spreading concerns over the South African version of Covid called Omicron are joining new disputes between the US and China over Xinjiang issues and US-Iran tensions to sway market sentiment in a sluggish session.

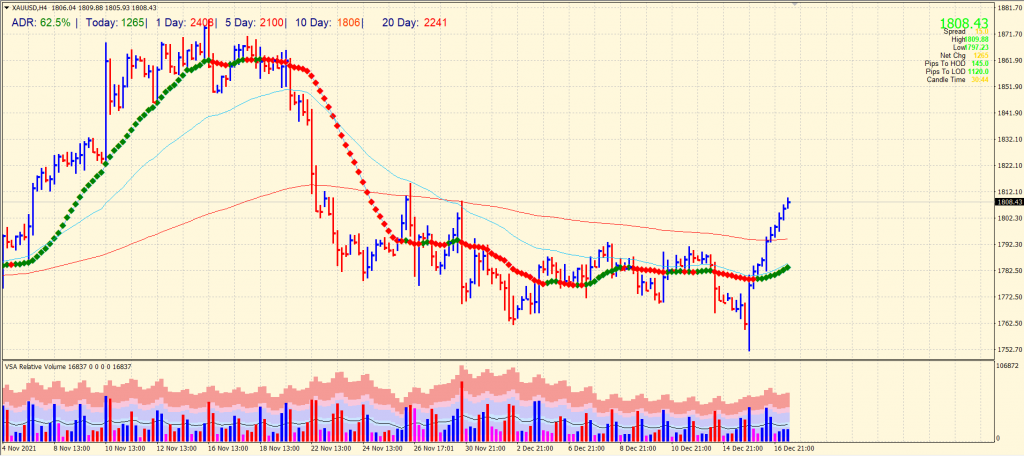

Gold price technical analysis: Key SMAs to support

The gold price remains positive above the key mark of $1,800. The yellow metal is just shy of a swing high level of $1,815. However, the price is well above the 20, 50, and 200 period SMAs on the 4-hour chart. The average daily range is 62% which indicates further volatility ahead. On the downside, $1,790 will be important to preserve the bullishness.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.