- Although USD/CAD bounces off the daily low, it remains negative near the weekly low throughout the day.

- After news of the imminent opening of the Iraqi-Turkish oil pipeline, oil prices have fallen from multi-year highs.

- As yields absorb early gains in Asia, sentiment is fading, but stock futures remain in the red.

The USD/CAD price analysis shows a bearish scenario as the pair falls below the 1.2500 mark. The recent fall is attributed to weaker USD and falling oil prices. During Wednesday’s European session, the USD/CAD price is hovering below 1.2500, down 0.12% on the day.

–Are you interested to learn more about forex brokers? Check our detailed guide-

A week ago in Asia, the loonie fell to a one-week low near 1.2479 before recently rebounding to 1.2515. Despite this, the pair remains negative for the third day in a row amid mixed concerns.

It is possible that Canada’s main oil export, WTI crude, has weakened recently, contributing to the weakening of the listing. The oil benchmark rose to an eight-year high in Asia as a pipeline explosion and skirmish between Russia and Ukraine were reported. A Turkish official’s recent statement that the pipeline would be reopened in an hour may have triggered a pullback in black gold to $85.20.

In addition, 10-year US Treasury yields fell from a two-year high of 1.89% earlier in the day to 1.87% at the latest, contributing to the US dollar’s weekly decline maximum. However, the US and European stock futures remain negative, testing the dollar’s bearishness.

Traders looking ahead to the BOC Consumer Price Index (CPI) data in December will be closely watching the commissioning and building permits for housing data in the United States.

Given the likelihood of a rate hike by the Bank of Canada, stronger Canadian inflation data will further push down USD/CAD rates. Nevertheless, oil prices and government bond yields are important catalysts for clear direction.

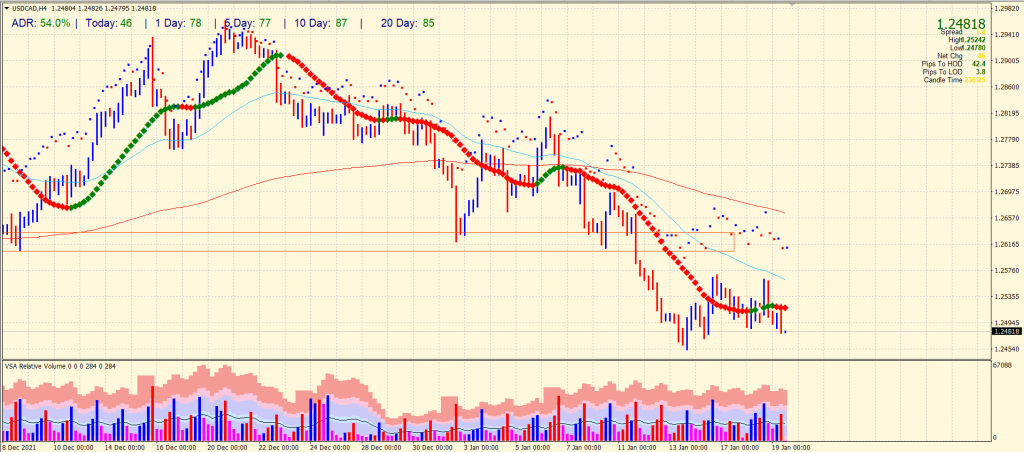

USD/CAD price technical analysis: Bears eying at 1.2450

The USD/CAD price dips below the 1.2500 handle and is going towards the swing lows around 1.2450. The pair is now offered well below the 20-period SMA on the 4-hour chart. On the downside, the price may fall towards 1.2400.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

On the flip side, if the price sustains above 1.2450, we may see a surge above 1.2500, leading towards 1.2550 and 1.2600.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.