- In spite of rising US Treasury yields, gold showed a weekly gain.

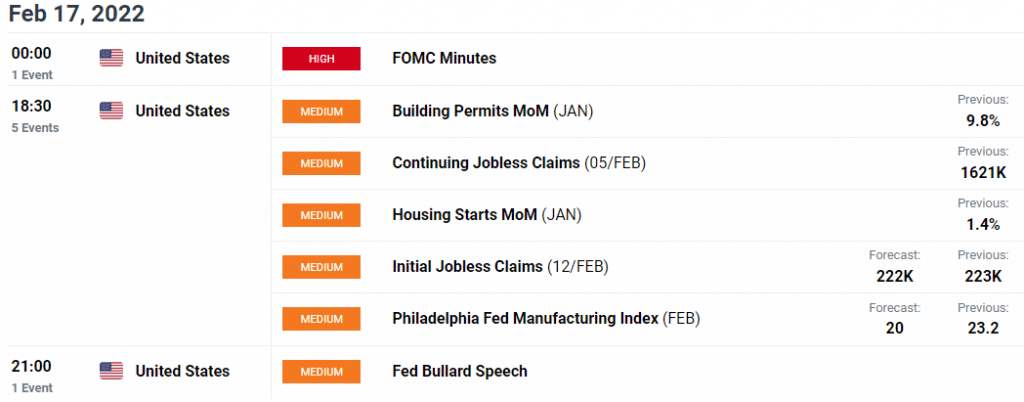

- FOMC minutes are expected to confirm or reject a 50-basis point hike in March.

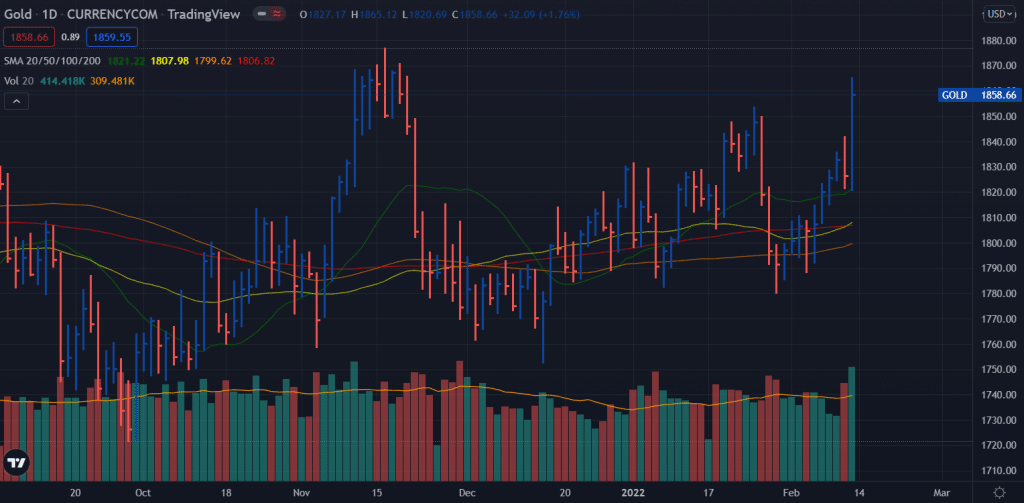

- The technical outlook points to buyers being in control.

The gold weekly forecast is bullish as the upbeat US CPI aids the gold buyers. On the other hand, firm USD may limit the gold rallies.

While US Treasury yields are rising, gold remains resilient, ending the week in positive territory for the second week in a row. The precious metal appears to have regained its inflation hedge status this week, and the technical outlook does not point to a deterioration in bearish momentum.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

Risk flows dominated financial markets earlier in the week as fears of a military conflict between Russia and Ukraine waned. On Monday, XAU/USD rose above $1,820 after the US dollar soared following a spectacular January jobs report last week.

In the absence of high-level macroeconomic data on Tuesday and Wednesday, bullish market sentiment remained prevalent, contributing to the growth of gold ahead of the long-awaited US inflation data.

The US Bureau of Economic Analysis reported on Thursday that the consumer price index rose 7.5% in January from 7% in December, the highest rate since 1982. Additionally, the consumer price index core, which excludes volatile food and energy prices, rose to 6% over the same period. The two reports met market expectations, and the yield on US Treasury bonds surged as a result. For the first time since July 2019, the yield on 10-year US Treasuries surpassed 2%. As a result, the dollar strengthened, and XAU/USD pulled back from its multi-week high of $1,841.

Besides the hot inflation data, bullish comments by St. Louis Fed President James Bullard also contributed to the greenback’s strength. Bullard was the first FOMC member to support a 50 basis point rate hike in March, stating he would like to see the Fed raise interest rates by 100 basis points by July.

Richmond Fed President Thomas Barkin expressed a more cautious outlook for interest rates separately. Barkin said he needs to be convinced that a rise of 50 basis points is urgently needed. After raising interest rates, it’s time to significantly reduce the balance sheet.

Markets are pricing a dose doubling in March at 90%, up from 33% only a week ago, according to CME Group’s FedWatch tool. That evening, several news outlets reported that Fed policymakers disagreed with Bullard’s remarks, and the likelihood of a rate hike in March dropped to 65%.

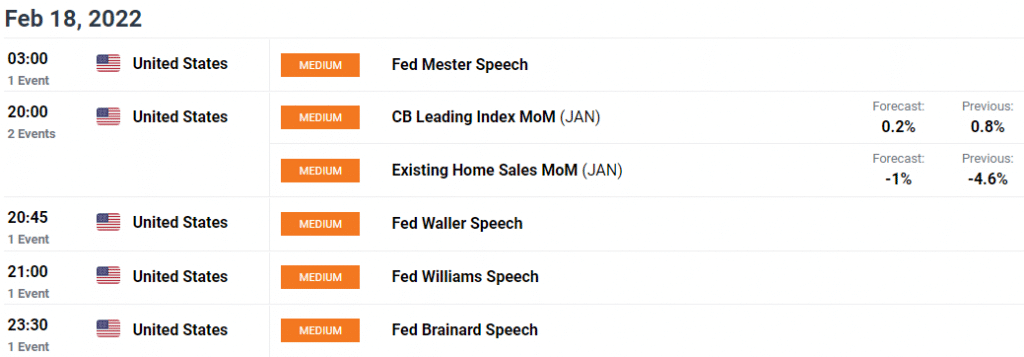

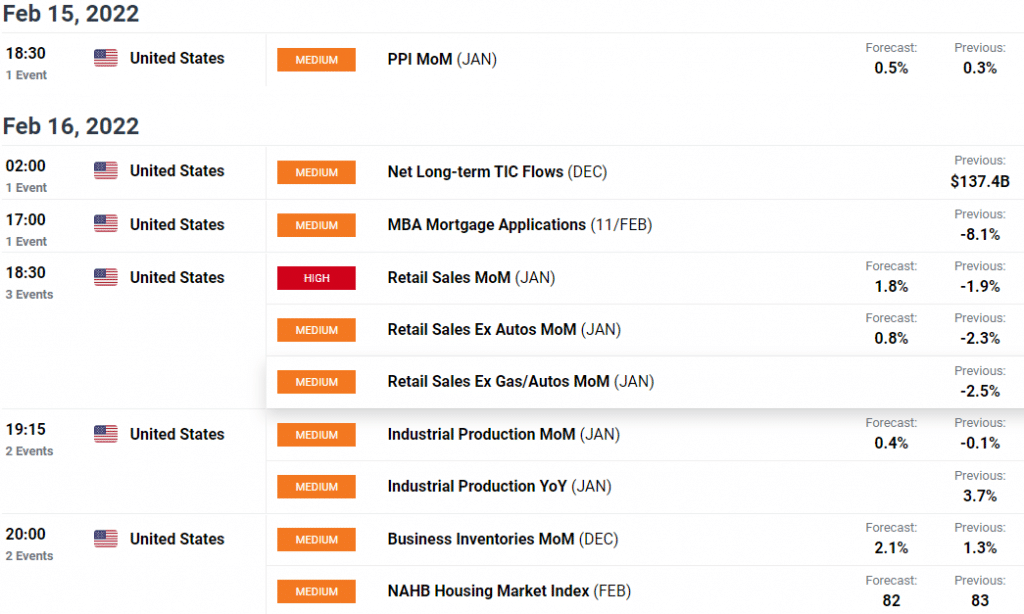

Key data for gold next week

Retail sales will be released in the US economy on Wednesday. Following a disappointing decline of 1.9% in December, markets expect retail sales to rise 1.7% m/m in January. However, as investors await the release of the Fed’s minutes of its January monetary policy meeting, market reaction is likely to be muted.

The Fed’s report will provide new clues as to the timing of the balance sheet cut. The dollar’s value could also be affected by officials’ views on inflation. The US dollar index could gain bullish momentum and make it harder for gold to keep rising if markets continue to evaluate aggressive monetary tightening. Even if XAU/USD loses support, this week’s movement has demonstrated that the yellow metal’s losses will likely remain limited.

While investors await confirmation that the Fed will raise rates by 50 basis points in March, they will closely watch Fed officials’ comments. The gold bulls might fade into the background if the 10-year US Treasury yields rise even further. XAU/USD is likely to grow further following a yield correction, on the other hand.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

Gold weekly technical forecast: Bulls fueled

The gold price remains far above the 20-day SMA, eying swing highs around $1,877. However, as the price is too far from the 20-day SMA, we may see some correction or consolidation when the new week begins. In addition, the bullish crossover of 50-day and 200-day SMAs may provide additional fuel to the bulls. On the flip side, $1,835 will be the interim support ahead of $1800 and then $1,780.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money