- After the week, sustained USD buying brought the GBP/USD lower.

- With the important data out of the picture, the week’s attention will be on the Russian-Ukrainian conflict.

- The risk-on environment may cap the safe-haven USD, limiting further losses for the pair.

Following the release of the US employment report, the GBP/USD weekly forecast saw some downward drift throughout the North American session and fell to a new low, nearer the 1.3100 level.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

DXY continues the bullish run

Following a good official March labor market report and a robust but significantly inflationary March ISM Manufacturing PMI survey release, the US dollar rose against the bulk of its G10 competitors.

A rise in US rates benefited the US dollar, notably at the short end of the curve. The bond market’s changes reflected Friday’s data, increasing the possibility that the Fed will raise interest rates in 50-basis-point increments in the coming quarters. In addition, more Fed members expressed openness to greater rate hikes.

What’s going on between Russia and Ukraine?

With the important data out of the way, the market’s attention is drawn to the latest developments in the Russia-Ukraine conflict.

On Friday, as Russian soldiers looked to be retreating from northern Ukraine, the Ukrainian military recovered land and crossed Russia for the first time, and struck a gasoline station in one of its most daring acts since the conflict started five weeks ago.

Investors are still confident about a breakthrough in the Russia-Ukraine peace negotiations and a diplomatic solution to the conflict. A goodish rise higher in the stock markets demonstrated this.

GBP/USD Forecast: Week Ahead

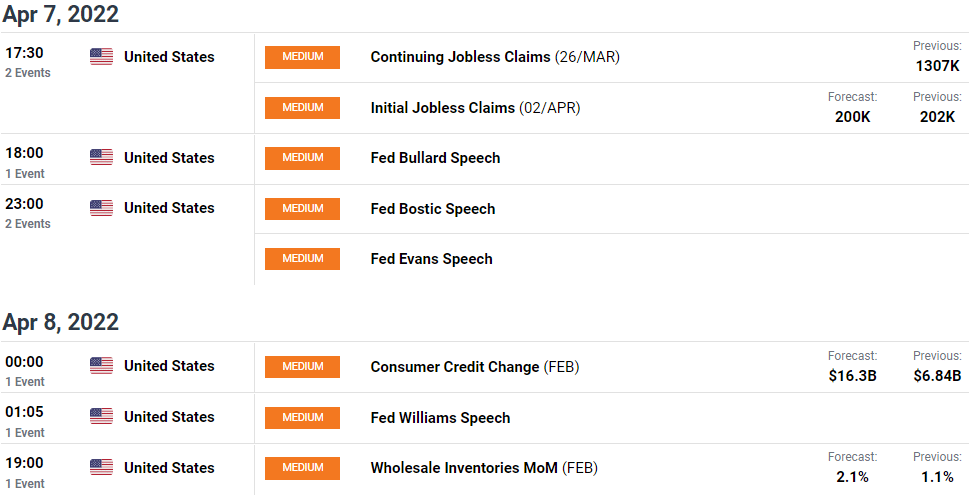

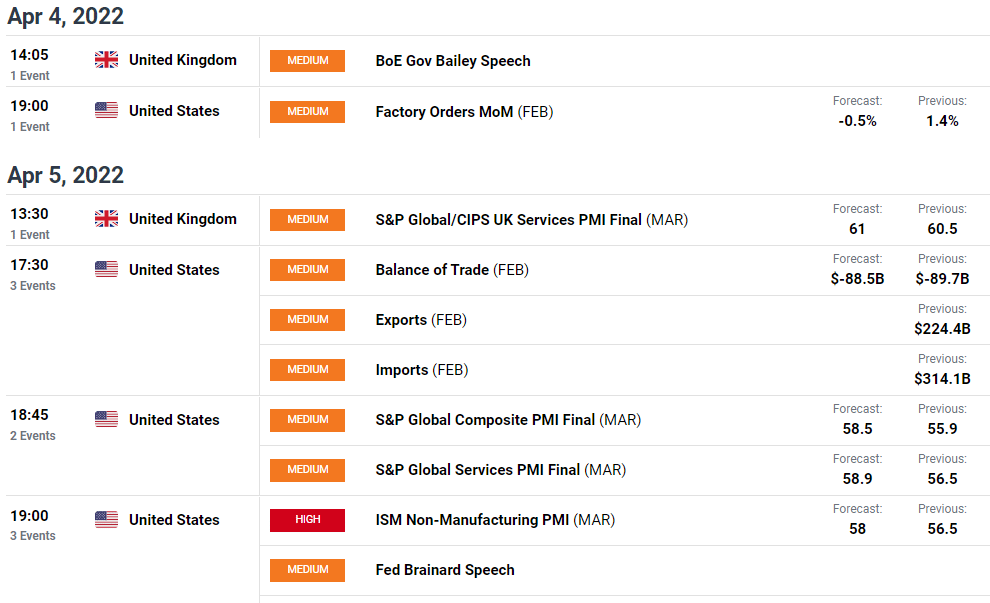

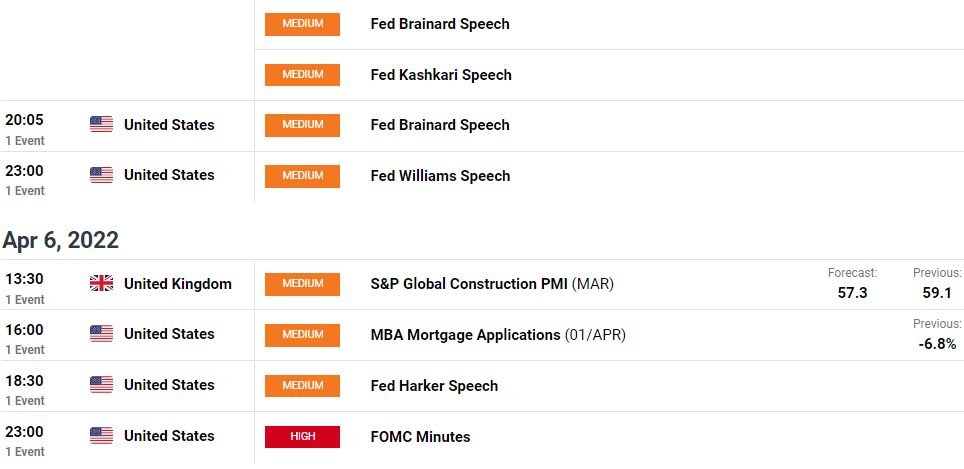

Some major releases are coming from the US as we move into April’s first week. First, we have the ISM Non-Manufacturing PMI and FOMC Minutes on Wednesday.

We don’t have much data from the other side of the Atlantic. Governor Bailey of the Bank of England will talk on Monday.

As a result, incoming geopolitical headlines will continue to significantly impact market risk perception. This, together with rising US bond rates, will boost USD demand and offer trading opportunities for the Cable.

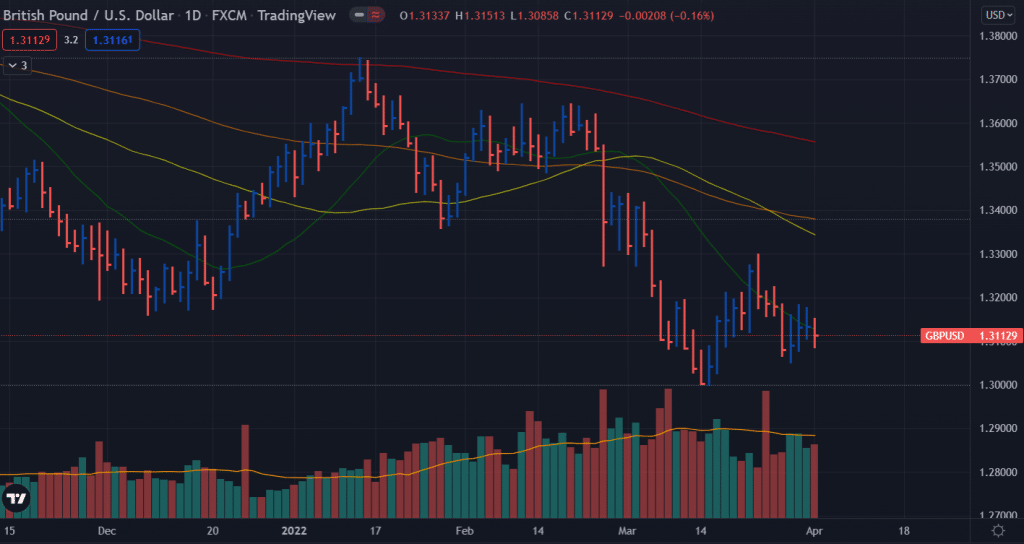

GBP/USD Technical Forecast: Eyeing downside levels?

The GBP/USD pair attempts to test the closest support level at 1.3110. However, the bulls continue to be rejected by the 20-day SMA.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

If the GBP/USD falls below this mark, it will go towards the 1.3080 support level. If the support level at 1.3080 is successfully tested, the following support level at 1.3050 will be tested.

The first resistance level for GBP/USD is around 1.3140 on the upswing. If the GBP/USD pair settles above this level, it will advance towards the next resistance level at 1.3175.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money