- A valid breakdown below the 61.8% could activate a larger drop.

- False breakdowns below the 61.8% could result in a new bullish momentum.

- DXY remains bullish despite temporary drops.

The NZD/USD price plunges after failing to stabilize above the 0.6800 psychological level. The USD took the lead again as the Dollar Index managed to rebound after its retreat. The DXY maintains a bullish bias despite temporary drops.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Technically, the currency pair rebounded, but this could be only a temporary gain. The price action signaled that the bounce-back ended and that the sellers could take full control again. Only DXY’s deeper drop could help the NZD/USD pair return higher.

Surprisingly or not, the USD appreciated even though the US data disappointed earlier today. For example, the Unemployment Claims indicator was reported at 184K above 177K expected in the last week, while the Philly Fed Manufacturing Index came in at 17.6 points below 21.5 estimates. In addition, the CB Leading Index rose by 0.3%, matching expectations.

Later, Fed Chair Powell’s speech shook the markets. The volatility gave the greenback solid support against its rivals.

The Kiwi lost significant ground after the New Zealand CPI reported a 1.8% growth versus the 2.0% expected.

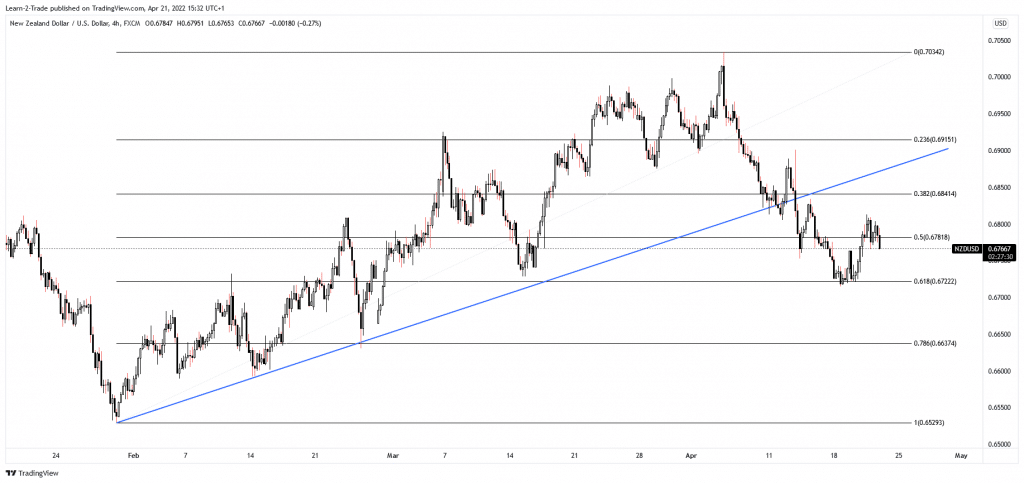

NZD/USD price technical analysis: Corrective phase

The NZD/USD pair failed to stabilize above the 50% (0.6781) retracement level, signaling that the rebound ended. Now, it’s traded at 0.6753 at the time of writing. The 61.8% (0.6722) retracement level is a major downside obstacle. A valid breakdown below may signal more declines and a potential downside reversal.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Technically, the pressure is high after dropping below the uptrend line. Temporary rebounds could bring new short opportunities. Still, only a new lower low, dropping and closing below 0.6715, could activate a larger downside movement. False breakdowns below the 61.8% or developing a major bullish pattern above this level could announce a new potential growth. Also, the price action could develop a range pattern above this critical support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money