- The XAU/USD maintains a bullish bias despite temporary drops.

- The US CPI and Core CPI represent high-impact indicators.

- Gold could register sharp movements after the US inflation publication.

The price of gold slipped lower after failing to stay near yesterday’s high of $1,722. It seems undecided in the short term.

The traders are waiting for the US inflation data before taking action. It was trading at $1,708 at the time of writing. Today, the fundamentals could move the price. That’s why you have to be cautious.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

The Consumer Price Index m/m is expected to report a 0.6% growth in October versus the 0.4% growth in September, CPI Y/Y is expected to report a 7.9% growth, while Core CPI m/m may register a 0.5% growth versus the 0.6% growth in the previous reporting period. In addition, the Unemployment Claims are expected at 220K in the previous week, above 217K in the previous reporting period.

As you already know, the XAU/USD rallied after the US Unemployment Rate jumped from 3.5% to 3.7% in October, above the 3.6% expected. Also, the traders expect only a 50 bps rate hike in December and February if the US reports lower inflation.

It remains to see how the yellow metal reacts later today. Higher inflation could be bad for gold as the FED could deliver a 75 bps hike again, forcing the greenback to dominate the currency market.

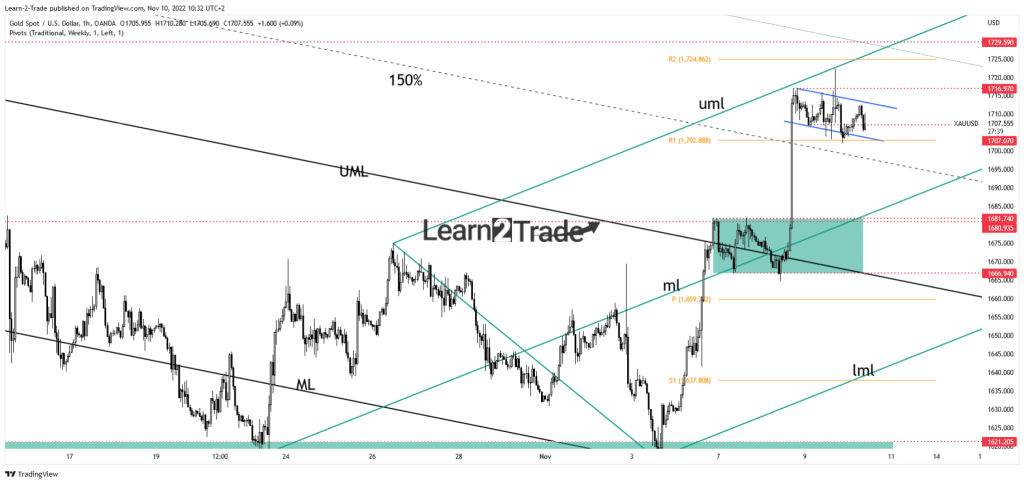

Gold price technical analysis: Flag pattern

Technically, the gold price climbed as much as $1,722. However, it has failed to hit the upper median line (UML) or the R2 (1,724) upside obstacles. The metal has registered only a false breakout through the $1,716 signaling exhausted buyers. Now, it moves sideways within a flag pattern. Unfortunately, after the false breakout, the pattern could be invalidated.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

As long as it stays above the R1 (1,702), XAU/USD could still resume its growth. The 1,729 historical level represents an upside target. Today, the price could register sharp movements in both directions. The $1,700 key level around 150% Fibonacci line and the median line (ML) represent downside obstacles.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.