- Retail sales in the United States dropped more than anticipated in March.

- Last week saw an increase in initial claims for US unemployment benefits.

- Employment in Australia exceeded forecasts for a second consecutive month in March.

The AUD/USD weekly forecast is slightly bearish as the dollar regains its shine as a safe-haven asset amid increased recession worries.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

Ups and downs of AUD/USD

This week, the US released several key economic reports pointing to a slowdown.

Retail sales in the United States dropped more than anticipated in March, indicating that the economy was slowing down. Retail sales are anticipated to stay low, given the weakening labor environment.

Last week saw a greater-than-expected increase in initial claims for unemployment benefits, a sign that the labor market was loosening as higher interest rates slowed demand.

The Labor Department on Thursday also released data showing producer prices declining by the most in practically three years in March. Consumer prices in the United States barely increased in March as gas costs fell.

According to the Federal Reserve’s March policy meeting minutes, the Federal Open Markets Committee (FOMC) expressed worry about the regional bank liquidity problem.

All these reports paint a picture of a deteriorating economy, raising recession concerns.

In March, employment in Australia exceeded forecasts for a second consecutive month, and the unemployment rate remained close to 50-year lows. This strong news suggests that the RBA’s tightening campaign is still on.

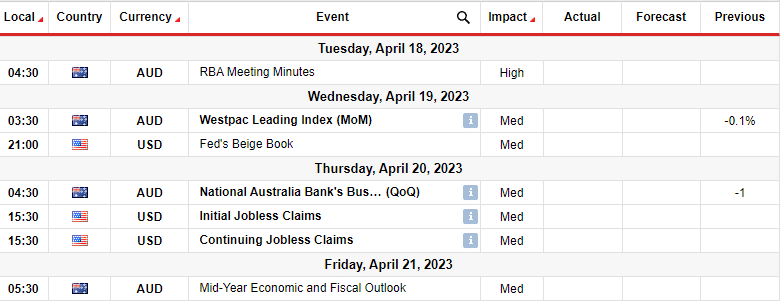

Next week’s key events for AUD/USD

Investors will pay attention to the Reserve Bank of Australia meeting minutes that might give more clues on the RBA’s next policy move. The US will also release its weekly employment data showing the country’s unemployment state.

AUD/USD weekly technical forecast: Bears emerge at 0.6800

AUD/USD is moving sideways in the daily chart. There is no clear direction as the price is chopping through the 22-SMA and the RSI through the 50-level. However, since this consolidation comes after a bearish move, there is a high likelihood that the downtrend will continue.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

A bearish bias means the price might break below the 22-SMA. At the moment, bears have taken charge after the price failed to go above the 0.6800 resistance. The RSI is also crossing below 50, supporting bearish momentum. We might see a break below 0.6575 and a retest of the 0.6400 support in the coming week.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.