- The bias remains bearish despite temporary rebounds.

- Dropping again below the median line (ML) activates more declines.

- The US data could bring more action today.

The gold price is trading in the red at $1,952 at the time of writing. The metal has rebounded after reaching a new low of $1,936 yesterday.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

After its massive drop, a corrective upside was due to a broad bearish trend. The XAU/USD bounce back can be short-lived, with the key focus on the US data ahead.

Gold plunged in the last trading session as the Prelim GDP reported a 1.3% growth exceeding the 1.1% growth estimated. Unemployment Claims came in at 229K in the last week compared to 249K forecasts, while Prelim GDP Price Index surged by 4.2%, beating the 4.0% growth expected.

Today, the US Core PCE Price Index may report a 0.3% growth, Durable Goods Orders are expected to register a 1.0% drop, while Core Durable Goods Orders could increase by 0.0%.

Furthermore, the Revised UoM Consumer Sentiment, Goods Trade Balance, Personal Income, Personal Spending, Prelim Wholesale Inventories, and Revised UoM Inflation Expectations data will also be released. Better-than-expected data could boost the USD and push the XAU/USD down.

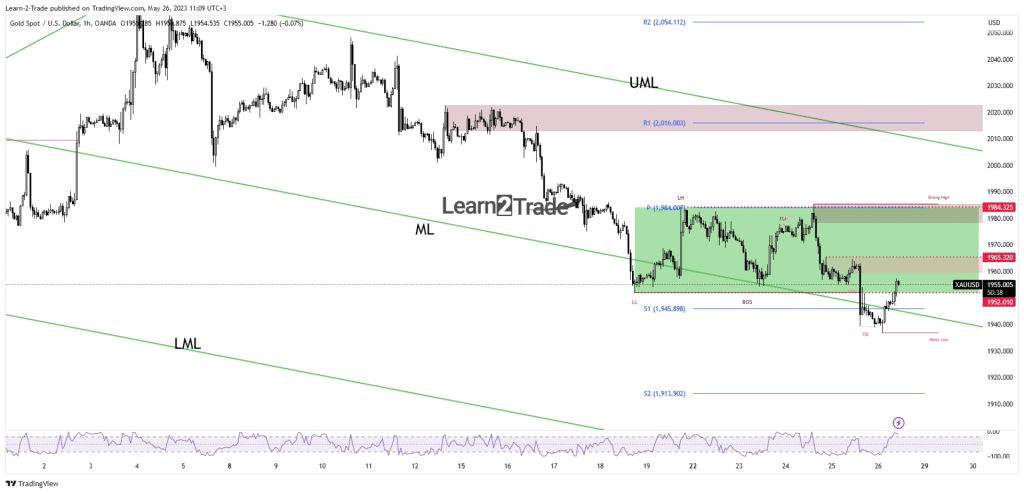

Gold price technical analysis: Bearish pattern violated

The XAU/USD has rebounded to retest the immediate resistance levels. As you can see on the hourly chart, gold escaped from the range pattern between $1,984 and $1,952 levels signaling a deeper drop.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

The precious metal has dropped below the median line (ML) and under the weekly S1 (1,945) downside obstacles, but it has failed to stay there, showing an oversold condition.

The $1,965 represents a stiff resistance. We have a strong liquidity zone below this resistance level. The price could turn to the downside after reaching the supply zone. Returning below the median line (ML) and making a new lower low can activate more declines.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.