- Australia’s central bank maintained steady interest rates for a fourth consecutive month.

- US job openings figures came in higher than expected.

- Instead of cooling job growth, US employers added 336,000 positions.

The AUD/USD weekly forecast leans bearish amid a robust US labor market despite elevated interest rates. The pair ended the week with slight gains.

Ups and downs of AUD/USD

The Aussie had a bearish week but closed well above its weekly lows. The pair had a volatile week with major events in Australia and the US.

–Are you interested to learn more about forex options trading? Check our detailed guide-

On Tuesday, the Australian dollar dropped because the country’s central bank maintained steady interest rates for a fourth consecutive month. However, after that, the dollar mostly weakened before and after the nonfarm payrolls report. In September, US employers defied the expectations of Federal Reserve officials. Instead of cooling job growth, they added 336,000 positions.

Moreover, this resurgence in hiring, reminiscent of the rapid pace seen during the pandemic, could strengthen the argument for another interest rate increase. Notably, the weakness in the dollar was likely due to profit-taking, which allowed the Aussie to climb on Friday.

Next week’s key events for AUD/USD

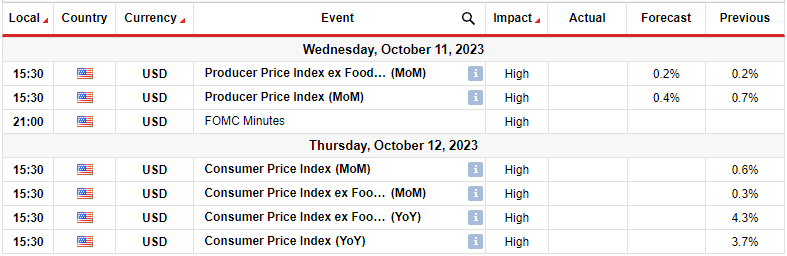

While Australia will not release major economic reports, investors will watch inflation data from the US. Moreover, the US will release the FOMC meeting minutes. The producer price index shows wholesale inflation. Investors expect a drop in this value from 0.7% to 0.4%.

However, investors will focus more on the consumer price index as this value will influence the Federal Reserve’s monetary policy outlook. A higher-than-expected value for consumer inflation would increase bets on one more Fed rate hike in 2023.

AUD/USD weekly technical forecast: Bears lose steam at the 0.6300 support.

The bias for AUD/USD on the daily chart is bearish because the price trades below the 30-SMA. At the same time, the RSI is below 50, supporting bearish momentum. Nevertheless, bulls are challenging the bearish bias at the 22-SMA resistance.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Bulls have made several attempts to break above this level, but all have resulted in wicks. Still, it has also led to a weaker downtrend as bears have lost momentum. The RSI has made a big bullish divergence, allowing bulls to return at the 0.6300 support level.

The trend will reverse if bulls break above the 22-SMA and the 0.6400 and the 0.6502 resistance levels. Otherwise, the downtrend will continue.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.