- XAU/USD retests the buyers after closing above the upper median line.

- The US data could be decisive today.

- Dropping below the S2 invalidates the upside scenario.

The gold price made waves yesterday, hitting a high of $1,965 before taking a step back to $1,954. This retreat was anticipated after the recent rally. The DXY’s rally played a role in pushing the value of gold down once again.

-Are you looking for forex robots? Check our detailed guide-

The Consumer Price Index (CPI) showed a 0.2% decrease in China, slightly more than the expected 0.1% drop. The Producer Price Index (PPI) also fell, recording a 2.6% decrease compared to the predicted 2.7%. Across the Pacific, the US Unemployment Claims exceeded expectations, boosting the dominance of the US dollar in the currency market.

Today, economic figures from the UK brought about some market volatility. Indicators such as GDP, Prelim GDP, Construction Spending, Goods Trade Balance, Index of Services, and Industrial Production surpassed expectations, adding extra excitement.

Looking ahead, the US is gearing up to release the Preliminary University of Michigan (UoM) Consumer Sentiment, expected at 63.7 points, a potential high-impact event that could lead to significant market movements. Additionally, Preliminary UoM Inflation Expectations data will be unveiled. Positive figures from the US may strengthen the US dollar and put pressure on the XAU/USD pair. Conversely, weak US data could provide support for the price of gold. Stay tuned for these developments in the financial landscape.

Gold price technical analysis: Corrective downside

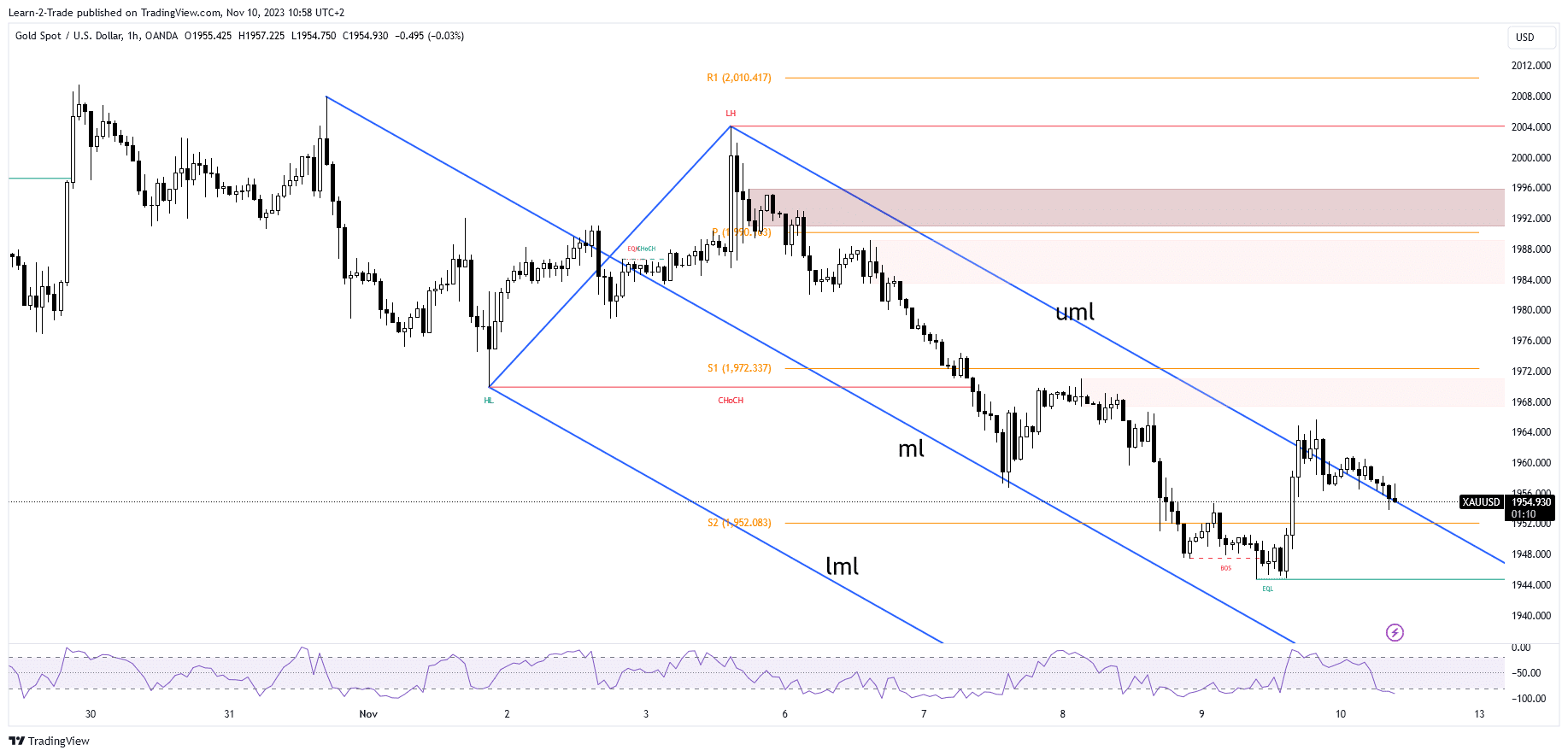

Looking at the technical side of things, XAU/USD has circled back to examine and retest the previously breached upper median line (uml) to solidify the breakout. The inability to retest the median line (ml) signaled fatigue among sellers. Gold might be gearing up for a fresh bullish trend, maintaining its positive outlook as long as it holds above the upper median line (uml) and stays above the weekly S2 level at $1,952.

-Are you looking for the best CFD broker? Check our detailed guide-

The key here is to watch that static support at $1,952. Only a dip below this level would hint at a more significant decline and could undermine the optimistic scenario. Beware of false breakdowns beneath immediate support levels, as they might signal a renewed upward momentum. In the complex world of financial markets, staying attuned to these technical nuances is crucial for a comprehensive understanding of potential price movements.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.