- The dollar got a boost from an upbeat employment report.

- Australia’s central bank kept interest rates unchanged on Tuesday.

- Investors are eagerly awaiting the FOMC policy meeting.

There is a touch of bearish sentiment in the AUD/USD weekly forecast as the dollar recovers after an upbeat employment report. This recovery could spill into next week.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Ups and downs of AUD/USD

AUD/USD had a bearish week as the Australian dollar was vulnerable after the RBA meeting. Meanwhile, the dollar got a boost from an upbeat employment report. As anticipated, Australia’s central bank kept interest rates unchanged on Tuesday. This decision gives the bank additional time to evaluate the economy’s condition and determine whether to implement further tightening next year.

Meanwhile, in the US, employment data earlier in the week pointed to a weakening labor market. However, the all-important NFP report showed that job growth increased while unemployment fell. Therefore, there is still strength in the labor market, which boosted the dollar on Friday.

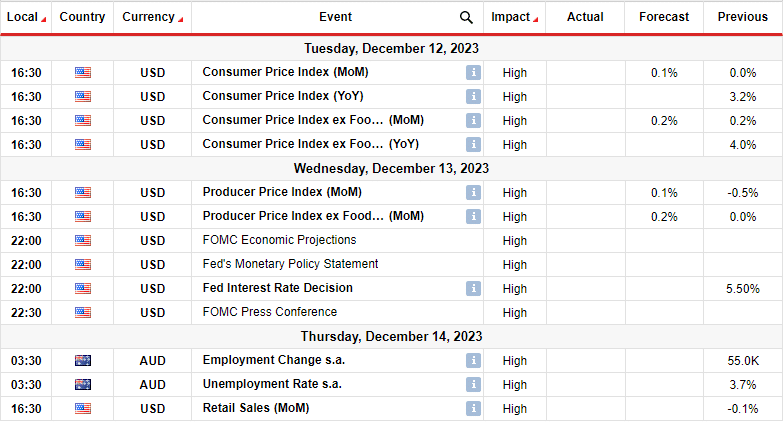

Next week’s key events for AUD/USD

Next week, the US will release key inflation and retail sales reports. Additionally, investors are eagerly awaiting the FOMC policy meeting. Meanwhile, Australia will release employment data.

The US consumer and producer price index reports will show the state of price growth for consumers and at the wholesale level. These will have a huge impact on the Fed policy meeting. Notably, recent data has supported the view that the Fed is done with rate hikes. Therefore, a drop in inflation could increase rate-cut bets.

At the FOMC meeting, market participants expect the Fed to hold rates at the current level. However, they will focus on the statement after the meeting for clues on what the Fed will do in the future.

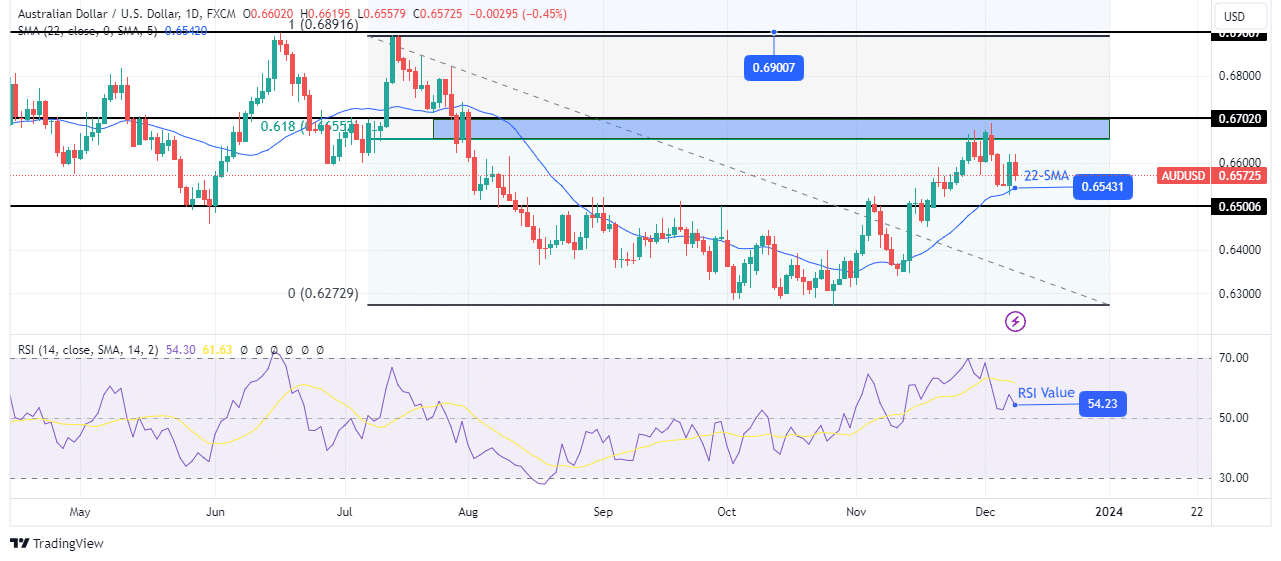

AUD/USD weekly technical forecast: Bulls face resistance at the 0.618 fib

On the technical side, AUD/USD is in a bullish trend. The price closed above the 22-SMA, and the RSI is above 50. Moreover, the price has respected the 22-SMA as support, making a strong bullish candle from the level. Consequently, the price has made a higher high and low, showing a bullish trend.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

However, the price is also retracing the most recent downtrend. It has reached the 0.618 key fib level that could reverse the current move. Furthermore, resistance at the 0.6702 key level could also stop the bullish move. The bullish trend could continue next week. However, the strong resistance zone might reverse the move.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.