- The dollar pulled back from recent highs as investors took profits.

- The Aussie gained despite a significant drop in Australia’s employment.

- Australia’s unemployment rate soared to a two-year high.

Thursday’s AUD/USD forecast was bullish, with the dollar pulling back from recent highs as investors took profits. Consequently, the Aussie gained despite a significant drop in Australia’s employment. Investors are taking profits on the dollar’s rally after the US inflation report. As a result, major currencies across the board got some relief. However, this might only be a short pause before the uptrend continues.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The upbeat US inflation report led to a change in the outlook for the Fed’s policy. Notably, there was a big drop in rate cut expectations as traders eliminated the chance that the Fed would cut in March. Moreover, the chances of a May cut fell as markets looked to June for the first cut. Currently, there is an 80% likelihood of a June rate cut. Additionally, markets expect three 25-bps cuts in 2024, compared to five similar cuts expected two weeks ago.

Meanwhile, the outlook for monetary policy in Australia took a different turn on Thursday after the release of poor employment figures. Employment missed forecasts in January, showing a slowdown in the labor market. At the same time, the unemployment rate soared to a two-year high.

For the RBA, this report is a good sign that demand in the labor market is slowing down. Consequently, it raises the chance that the central bank will cut rates. Notably, policymakers said rate hikes were still possible. However, markets believe the RBA’s next move will be a rate cut, especially since the economy is slowing down.

AUD/USD key events today

- US core retail sales m/m

- US Empire State Manufacturing Index

- US retail sales m/m

- US unemployment claims

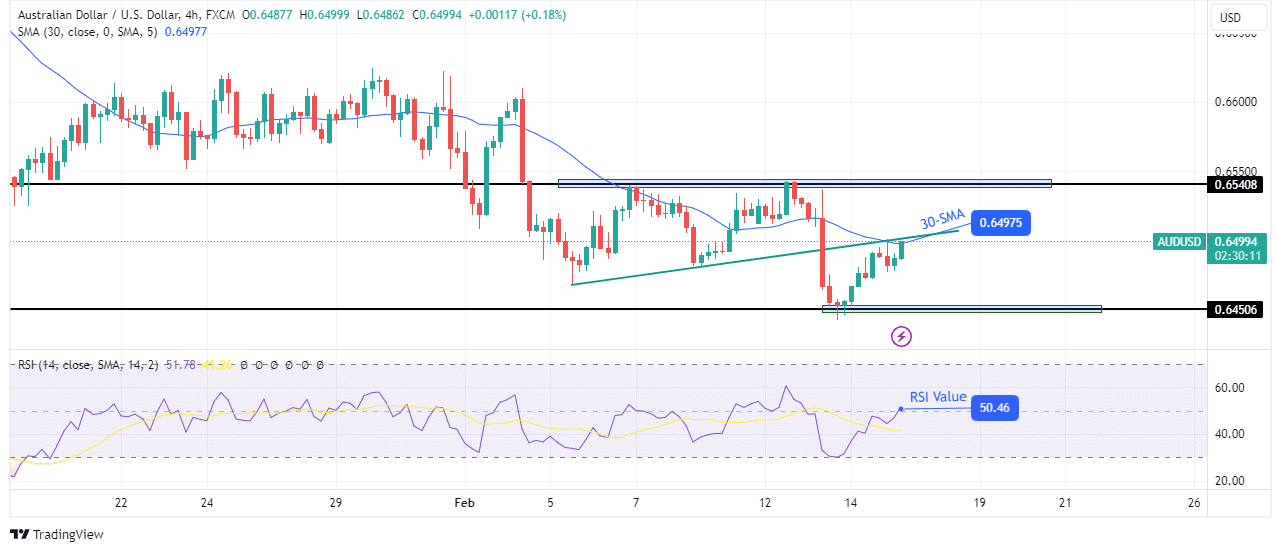

AUD/USD technical forecast: 30-SMA and trendline confluence

On the technical side, AUD/USD has pulled back to retest the 30-SMA resistance and the recently broken trendline. At the same time, the RSI has risen to the pivotal 50 level that separates bearish from bullish momentum.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

Notably, the price has been on a downtrend and recently made a new low near the 0.6450 key level. Therefore, if bears are still strong, it might reverse at the current resistance zone or slightly higher to retest the 0.6450 support level. A break below this level would confirm a continuation of the downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.