- The risk of UK inflation stalling above the central bank’s target has dropped.

- UK inflation fell to 3.2% in March from 3.4% the previous month.

- Services inflation in the UK remained relatively high at 6.0% in March.

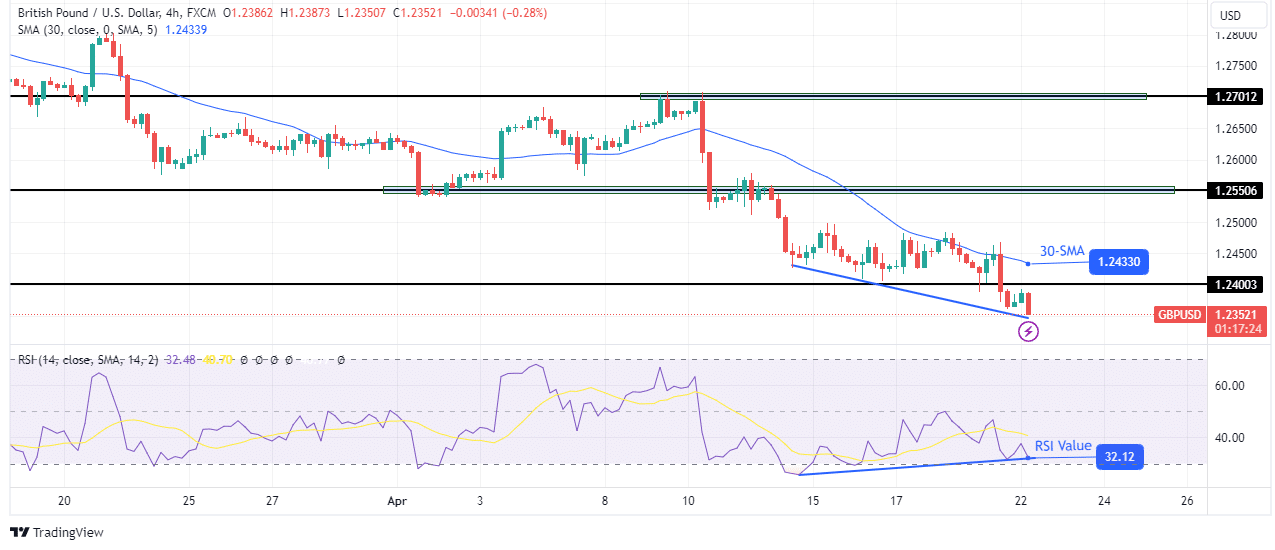

Expectations for the GBP/USD forecast are bearish as the pound continues to decline following last week’s dovish remarks from the Bank of England. At the same time, the recent drop in Fed rate cut delays kept the dollar on the front foot.

-Are you looking for automated trading? Check our detailed guide-

On Friday, the BoE deputy governor noted that the risk of UK inflation stalling above the central bank’s target had dropped. Moreover, inflation might ease more than the central bank forecasted in February.

Notably, these remarks followed the recent release of UK inflation data. According to the report, inflation fell to 3.2% in March from 3.4% the previous month. Although the decline was smaller than expected, policymakers welcomed it. BoE governor Andrew Bailey said that inflation in the country was falling as expected.

However, service inflation in the UK remained relatively high at 6.0% in March. This might cause some policymakers to hesitate before calling for rate cuts. Another thing that might hold the Bank of England back is the outlook for Fed rate cuts.

Last week, Fed Chair Powell confirmed that the central bank might need to keep a restrictive policy in place for longer. These remarks came after a series of better-than-expected economic reports from the US. Now, markets expect the Fed to start cutting interest rates in the fourth quarter. Consequently, this has led to declining expectations for rate cuts for other major central banks.

GBP/USD key events today

No high-impact economic reports are coming from the UK or the US today. Therefore, the pair might extend its move from Friday.

GBP/USD technical forecast: Weakening below the 1.2400 barrier

On the technical side, the GBP/USD price is making new lows after bears broke through the 1.2400 barrier. This decline indicates a continuation of the downtrend. However, as the price makes lower lows, the RSI has remained above its previous low, indicating a bullish divergence. This is a sign that bearish momentum has weakened.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Therefore, there is a chance bulls will resurface to reverse the trend. A break above the 30-SMA would allow the price to retest the 1.2550 critical level. However, if bears regain momentum, the decline will continue to the next key support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money