- US jobless claims fell more than expected, indicating solid demand for labor.

- US PMI data showed growth in the manufacturing and services sectors.

- Tokyo CPI numbers showed inflation easing below the central bank’s 2% target.

The USD/JPY weekly forecast supports further upside as markets anticipate a gradual Fed rate-cutting cycle and a less hawkish BoJ.

Ups and downs of USD/JPY

The USD/JPY pair had a bullish week as market participants focused on the US economy’s resilience. At the same time, inflation figures in Japan eased, lowering expectations for BoJ rate hikes.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

US data during the week showed that jobless claims fell more than expected, indicating solid demand for labor. Meanwhile, PMI data showed growth in the manufacturing and services sectors. Consequently, there is less pressure on the Fed to lower borrowing costs.

In Japan, Tokyo CPI numbers showed inflation easing below the central bank’s 2% target, complicating the outlook for BoJ rate hikes and weighing on the yen.

Next week’s key events for USD/JPY

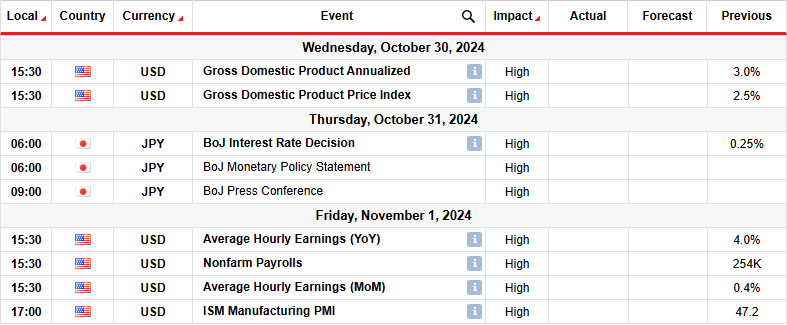

Next week, the Bank of Japan will hold its policy meeting and likely keep rates unchanged. Meanwhile, the US will release data on GDP, monthly employment and manufacturing PMI. The outlook for rate hikes in Japan has shifted with the new Prime Minister and incoming economic data. Ishiba noted that the economy was not ready for more rate hikes. Meanwhile, inflation data has shown weak consumption, further challenging the outlook.

On the other hand, the US economy has remained resilient with robust demand. Therefore, there is a high chance the NFP report will show strong job growth, reducing bets for a November Fed rate cut.

USD/JPY weekly technical forecast: 0.618 Fib resistance poses challenge

On the technical side, the USD/JPY price has started a new bullish trend that has paused near the 153.00 resistance level. The bullish bias is strong since the price has traded well above the 22-SMA since bulls took control. At the same time, the RSI has stayed near the overbought region, suggesting solid bullish momentum.

–Are you interested to learn more about forex signals? Check our detailed guide-

However, the new bullish trend is facing a solid resistance zone comprising the 0.618 Fib retracement level and the 153.00 psychological level. Therefore, the price might pause at this level before either breaking above or pulling back to retest the SMA support. Nevertheless, as long as USD/JPY stays above the SMA, it will eventually break the resistance zone and retest the 158.04 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money