- The yen rallied after Shigeru Ishiba won Japan’s election.

- Ishiba supports the recent Bank of Japan policy moves.

- The dollar fell due to softer-than-expected inflation numbers.

The USD/JPY weekly forecast leans South due to an increased likelihood of more rate hikes in Japan and cuts in the US.

Ups and downs of USD/JPY

The USD/JPY pair had a bearish week as the yen rallied after Japan’s election. Meanwhile, the dollar fluctuated due to mixed economic data. The tight election for the Prime Minister seat in Japan ended with a win for former defense minister Shigeru Ishiba. The yen rallied after the result because Ishiba supports the recent Bank of Japan policy moves. Therefore, analysts believe there will be more rate hikes under his leadership.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Meanwhile, the dollar initially had a solid start to the week when data showed steady business activity and a decline in jobless claims. However, it ended weak due to softer-than-expected inflation numbers.

Next week’s key events for USD/JPY

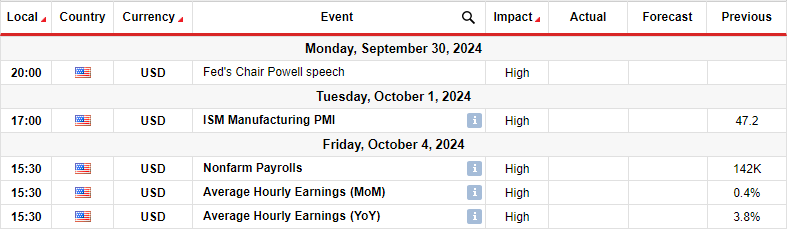

Next week, all eyes will be on US economic data, with none expected from Japan. The US will release figures on manufacturing business activity and employment. Additionally, a speech from Fed Chair Powell might contain clues about future rate cuts.

After the recent FOMC policy meeting, policymakers have taken a more dovish tone, implying more rate cuts in the future. Therefore, there is a chance Powell will continue with this trend, putting downward pressure on the US dollar.

Furthermore, the monthly jobs report will show the state of job growth and unemployment. Economists expect 144,000 more jobs in the economy, a slight increase from the previous reading. Meanwhile, the unemployment rate might hold steady at 4.2%.

USD/JPY weekly technical forecast: Bears pierce the 22-SMA

On the technical side, the USD/JPY price is on a bearish trend as the price trades below the 22-SMA, with the RSI in bearish territory. However, price action shows weakness in the downtrend. The price trades near the SMA and has punctured the line several times. This is a sign that bulls are getting stronger.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

Meanwhile, bears are weakening, as seen in the RSI, which has made a bullish divergence. Therefore, if the price fails to break below the 141.01 support in the coming week, it might break above the SMA. Such a break would indicate a shift in sentiment, allowing the price to climb to the 149.57 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money