The Bank of Japan did decide to ease monetary policy but did not do any big step. The BOJ will now buy ETFs at an elevated pace of 6 trillion yen instead of 3.3 trillion annualized beforehand. The BOJ will increase lending program that provides dollar funding. Perhaps for next time, the BOJ will have a full assessment of policies so far. So, also the next meeting will be interesting. But that’s about it. The helicopter does NOT fly.

But the central bank does not change the amount of bonds it buys. Also, the interest rates remain unchanged at -0.1% (negative). Corporate bond buys are maintained at current levels.

Even the decision to change ETF buys did not come easily: 2 out of 9 members voted against it.

Kuroda and his team continue seeing uncertainty about reaching their ever elusive inflation target. However, CPI should reach 2% in fiscal 2017.

Update: Kuroda opens the door for deeper negative rates – USD/JPY is unimpressed.

What’s next?

What’s next? The BOJ will conduct a comprehensive assessment of its policy effects in the next rate review. Another highly anticipated decision?

And the government is expected to announce a stimulus package on August 2nd, that’s Tuesday. So, perhaps the stimulus package will be lighter. Nevertheless, a package worth 28 trillion yen remains on the cards. The government welcomes the BOJ policy decision.

Are the authorities in Tokyo waiting for after the US elections?

Here is our preview: BOJ Preview: Will the helicopter fly or crash?

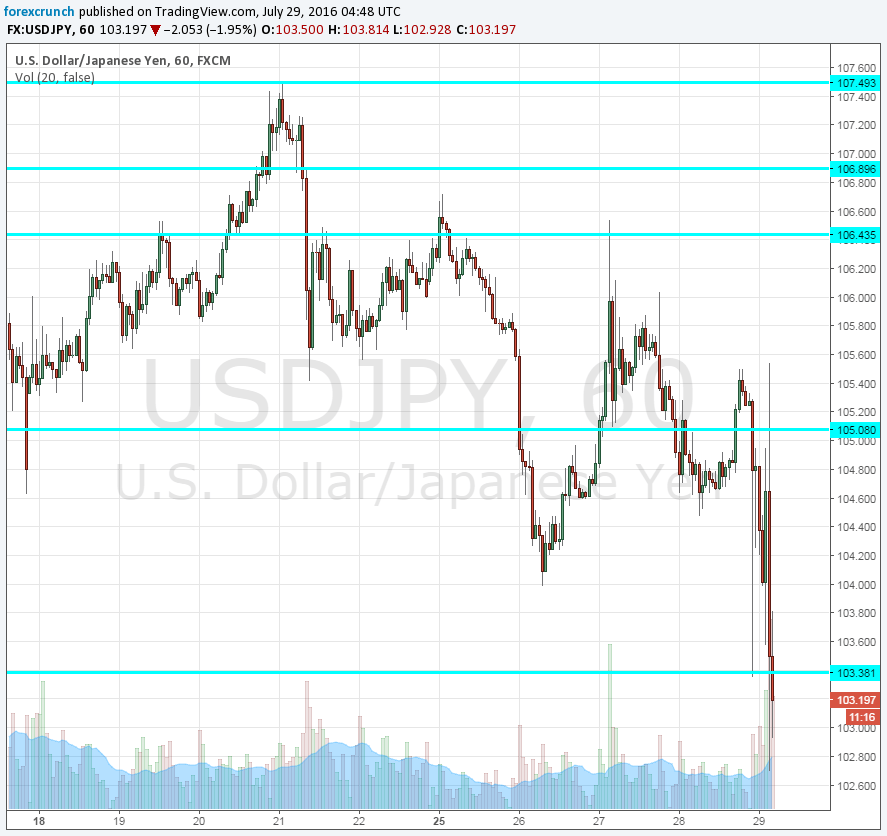

USD/JPY madness

USD/JPY, which was trading in a very erratic manner throughout the Asian session, has chosen the downside. JGB trading was temporarily halted early in the session.

The pair is currently trading at 103.30, after already rising to 105.54 earlier and also falling to 102.70. Post Brexit, the pair fell to 99 and after stabilizing, it found support above 100. Since then, hopes for action sent the pair to as high as 107.50 with 104 serving as support. The range has been around 280 pips.

So, the pair is now trading under that support. Markets are showing their disappointment.

Here is the chart: