After the BOJ fell short of expectations, Governor Kuroda met the press and offered promises to do more. He said that the Bank has not reached its policy limits and could add more stimulus as needed.

He refers to the QQE program: it has not reached its limits quite yet. Many disagree, and think that the next move will be helicopter money. And regarding rates, he explicitly says that they have room for even deeper negative rates.

How low can they go?

Kuroda also mentions that his organization holds “only” a third of government bonds. There are always more on the open market. Current operations are good enough for now. We repeatedly said that outright “helicopter money”, buying bonds outside markets, could be delayed to after the US elections.

Kuroda also hints about fiscal stimulus. He says that today’s actions, as well as the government’s ones, will provide “synergy effects” for the economy.

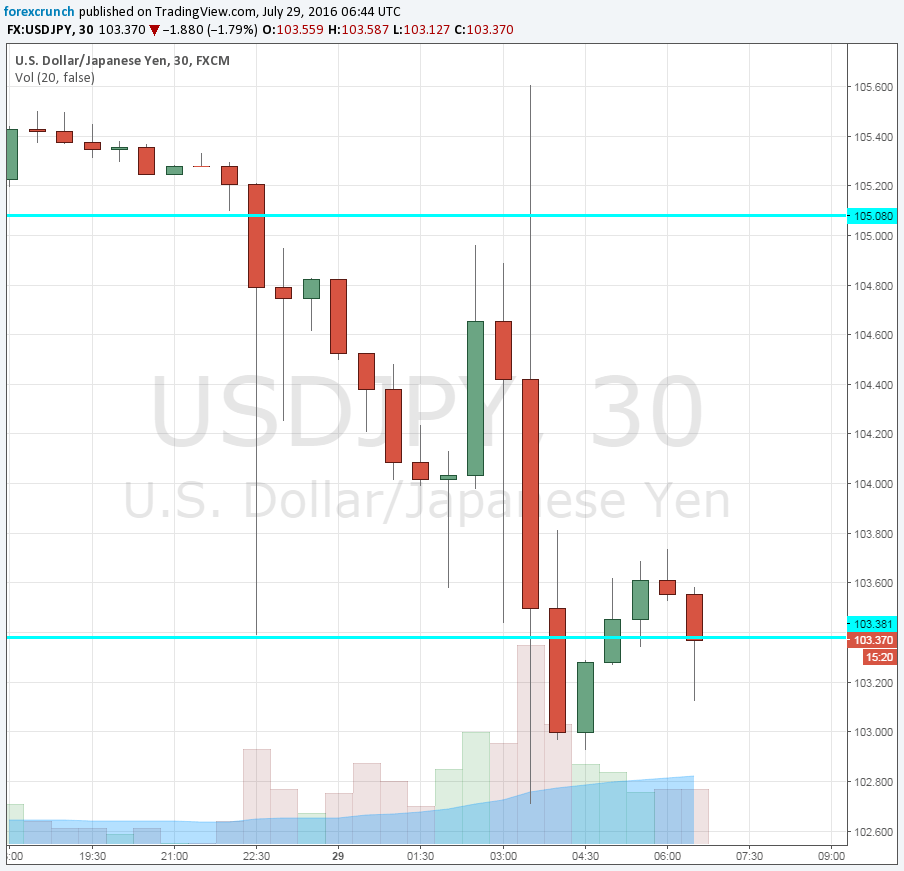

USD/JPY does not seem to be quite impressed. The pair continues its descent.