GBP/USD gained just over 1 percent last week, as the pair recovered the losses sustained a week earlier. This week features the BoE rate decision and PMIs. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, retail sales crashed in April, with a dismal reading of -55 points. A month earlier, the indicator came in at -5 points. The manufacturing sector showed a sharp contraction in March, with a reading of 32.6 points. This was down sharply from the April release of 47.8 points. Borrowing levels slowed to 1.0 billion pounds in March, down from 5.2 billion in February. This marked the lowest reading since 2013.

The Federal Reserve’s policy statement reiterated that the Fed would use its “full range of tools” to stabilize the battered economy, but also warned about “considerable risks” to the economy over the next year or more. At the meeting, the Fed maintained the benchmark rate, which is close to zero. On Thursday, the Fed announced that it was expanding the Main Street Lending Program, which helps small and medium-sized businesses in need of credit during the current financial crisis. On the manufacturing front, the ISM Manufacturing PMI slowed for a third straight month in April, falling to 41.5 points. This was down from 49.1 a month earlier, but beat the estimate of 36.7 points.

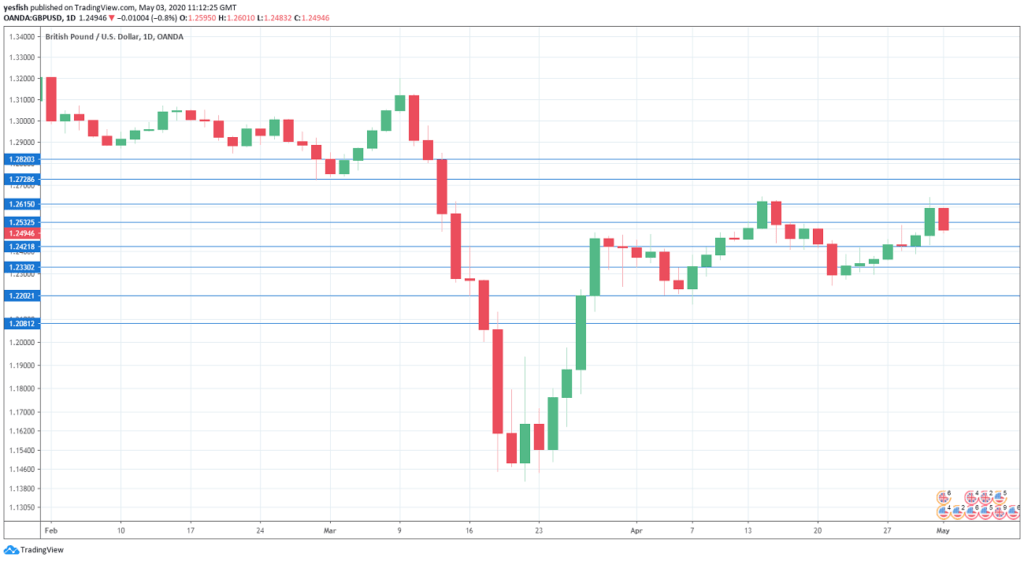

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Construction PMI: Monday, 8:30. The construction sector plunged to 39.3 in March, down from 52.6 a month earlier. This reading points to sharp contraction and was the lowest reading since 2009. The downturn is expected to continue, with a forecast of 21.0 points in April.

- Services PMI: Tuesday, 8:30. The PMI slowed to 34.5 in March, down from 53.2 in the previous release. Analysts are bracing for a miserable reading of just 12.0 points, which would point to a huge contraction in the services sector.

- GfK Consumer Confidence: Wednesday, 23:01. Consumer confidence has been mired deep in negative territory, with two straight readings of -34 points. No relief is expected in April, with an estimate of -37 points.

- BoE Rate Decision: Thursday, 6:00. The BoE is expected to maintain the official bank rate of 0.10%, which the bank cut the rate from 0.25 percent in March. Investors will be keeping a close look at the monetary policy summary, which may contain hints of future monetary moves.

- Halifax HPI: Thursday, 7:30. The housing inflation gauge continues to lose ground. In March, the indicator came in at 0.0%, down from 0.3% a month earlier. This missed the forecast of 0.2 percent. The downturn is expected to continue, with a forecast of -0.3 percent.

Technical lines from top to bottom:

We start with resistance at 1.2820.

1.2728 has held in resistance since early March. 1.2616 is next.

1.2535 is a weak resistance line.

1.2420 (mentioned last week) has switched to a support role after sharp gains by GBP/USD last week.

1.2330 is the next support line.

The round number of 1.22 has provided support since the first week in April.

1.2080 is protecting the symbolic 1.20 level. It is the final support line for now.

I remain bearish on GBP/USD

Corvid-19 has sent the manufacturing and services industries reeling, and economic conditions remain weak. The U.S. dollar remains a safe haven for jittery investors, which could mean trouble for the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!