The British pound had a rough week, as GBP/USD fell over 1 percent. There are three events in the upcoming week. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

In the UK, jobless claims came in at 12.1 thousand, well below the estimate of 170 thousand. Wage growth slipped to 2.8%, down from 3.1%. The unemployment rate climbed to 4.0%, up from 3.9%. Consumer inflation continues to fall and dropped to 1.5%. This was down from 1.7 percent. PMIs headed lower in March. Manufacturing PMI slipped to 32.9, down from 48.0 points. The services PMI is in free-fall, and dropped to 12.3 points, down from 35.7 a month earlier.

In the U.S., jobless claims dropped to 4.4 million, down from 5.5 million a week earlier. In the past five weeks, new jobless claims have totaled a staggering 26 million, as the Covid-19 crisis has shut down much of the U.S. economy. There was more bad news from March durable goods orders, which plunged by 14.4%, its first decline in four months. The core reading declined by 0.2%, after a decline of 0.6%. The UoM Consumer Sentiment slumped to 71.8, down sharply from 89.1 a month earlier. Still, this beat the estimate of 67.8 points.

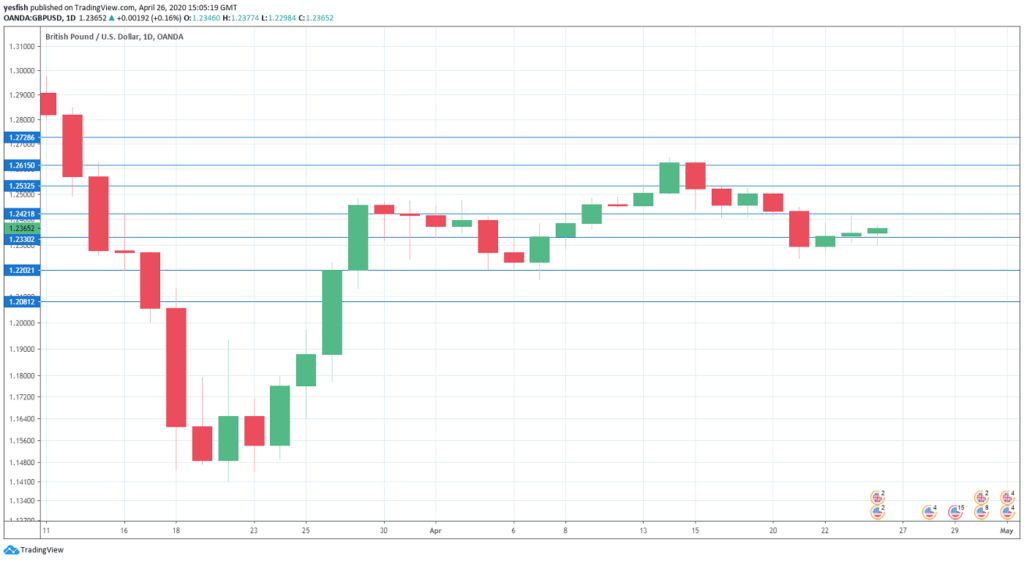

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Realized Sales: Tuesday, 10:00. Sales volume dropped to -3 points in March, the first drop in four months. Still, this reading was much better than the forecast of -15 points. Analysts are braced for a sharp drop to -45 points in the upcoming release.

- BRC Shop Price Index: Tuesday, 23:01. Retail sales in BRC shops continue to rack up declines. The March reading of -0.8% was the weakest figure since February 2018. Will we see an improvement in the April release?

- Final Manufacturing PMI: Friday, 8:30. The PMI slowed to 47.8 in March, down sharply from 51.7 points. The index is projected to slide to 32.8 in April, which is deep in contraction territory.

Technical lines from top to bottom:

1.2728 has held in resistance since early March. 1.2616 is next.

1.2535 has some breathing room in resistance after GBP/USD posted sharp losses.

1.2420 (mentioned last week) switched to a resistance role last week.

1.2330 is a weak support level. It could break early next week.

The round number of 1.22 has provided support since the first week in April.

1.2080 is protecting the symbolic 1.20 level. It is the final support line for now.

I remain bearish on GBP/USD

The Corvid-19 virus has hit the UK hard, causing over 20,000 deaths. The economy is expected to decline sharply, which will likely hurt the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!