- BTC price sits on strong support at the 200-day SMA

- The MACD and Parabolic SAR indicate sustained bullish momentum.

- Valkyrie files for approval for BTC futures ETF

BTC price is trading in the red for the third day in a row wherein Bitcoin dropped 4% from a hight of about $46,600 traded on August 09 to $44,800 low traded earlier today. This followed the entry of the Relative Strength Index (RSI) into the overbought zone that cause the trend reversal.

At the moment, the Bitcoin price prediction remains bullish as buyers eye the $50,000 psychological level.

BTC Price Bulls Must Defend the 200-SMA Support

At the time of writing, Bitcoin teeters around $45,192. The flagship cryptocurrency is sitting on an immediate support provided by the 200-day Simple Moving Average (SMA) at the $45,000 support wall.

To restart a recovery towards the $50,000 psychological level, Bitcoin bulls must defend this support level. Note that closing the day above this level may see BTC buyers start to regain the losses experienced over the last three days.

BTC/USD Daily Chart

This bullish outlook is accentuated by crypto signal from the movement of Moving Average Convergence Divergence MACD) indicator above the signal line in the positive region. has a clear bullish outlook highlighted by the indicator’s movement above the mean line. In addition, the parabolic SAR remains positive.

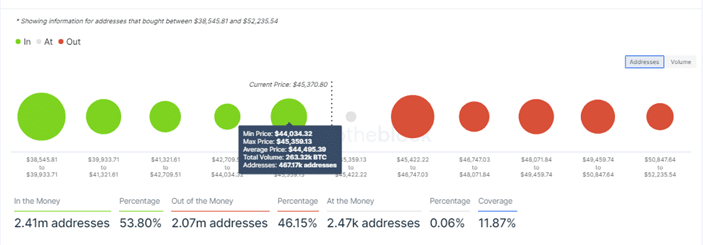

Furthermore, the IntoTheBlock’s IOMAP tells us that BTC price sits on robust support around the $45,000. This support area is found within the $44,034 and $45,359 investment cluster where around $467,170 addresses previously bought approximately 263,320 BTC.

Bitcoin IOMAP

Valkyrie Applies for BTC futures ETF

Alternative financial services company, Valkyrie Digital Assets, becomes the fourth firm to file for a Bitcoin exchange-traded fund (ETF). If approved, it will offer indirect exposure to Bitcoin through cash-settled futures contracts.

According to an August 11 draft prospectus presented to US SEC, the BTC futures contracts will be acquired through a subsidiary based in Cayman Island, wholly owned by the fund and through exchanges duly registered with the U.S. Commodity Futures Trading Commission.

The prospectus also discloses that the initially, the fund will invest in Bitcoin contracts traded on the Chicago Mercantile Exchange (CME):

“Currently, Bitcoin futures contracts in which the Fund will invest are only traded on, or subject to the rules of, the Chicago Mercantile Exchange (the “CME”). The value of bitcoin futures is determined by reference to the CME CF Bitcoin Reference Rate, which provides an indication of the price of Bitcoin across certain cash bitcoin exchanges. The Fund seeks to invest in cash-settled bitcoin futures.”

Bitcoin investors draw on such news to renew optimism of Bitcoin being widely adopted across the globe.

Bitcoin Could Reach These Levels

If the support at $45,000 fails to hold, sellers will enter the scene to push the BTC price towards the 100 and 50 SMAs at $38, 577 and $36, 507 respectively.

Looking to buy or trade Bitcoin now? Invest at eToro!

Capital at risk