Prices of oil are struggling at the lows. Even after bouncing nicely at low support, the price of black gold remains depressed. Nevertheless, the Canadian dollar is supported by the local economy.

Canadian retail sales advanced by 0.8%, significantly better than an increase of 0.3% that was expected. Also, core retail sales enjoyed a significant beat: 1.5% instead of 0.6% predicted.

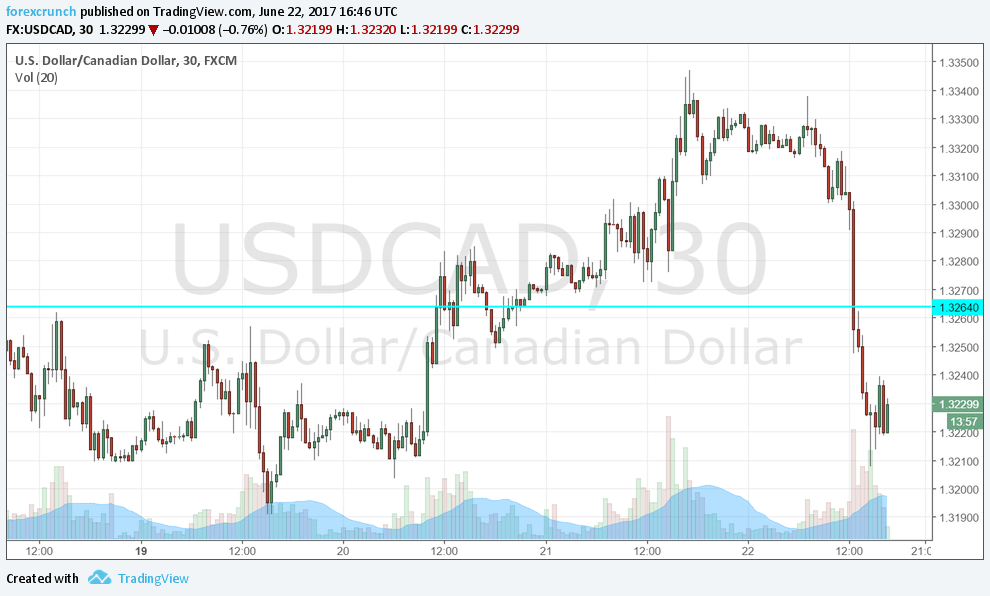

The result is a 100 pips dip of Dollar/CAD on the day.

The pair is currently trading at 1.3240, after nearly touching 1.3350 earlier in the day. Support awaits at 1.3160.

CAD is not only Crude

Some think that that the Canadian dollar is only about oil prices. Sure, they have a significant impact. However, the open economy also depends on trade with the US as well as with other partners. This retail sales report joins an excellent jobs report, a robust GDP one and upbeat manufacturing sales.

Most importantly, the BOC acknowledges this strength and has shifted its stance to a hawkish one. A rate hike is forecast for October.

Here is the reaction to the retail sales report on the Dollar/CAD chart. Will this last? There are some worries below.

Canadian housing is a worry

There is only one thing that could ruin the party for the C$: house prices. Talk of a bust in Canadian housing prices has been looming for years, but it might begin happening in Toronto. After the provincial government of Ontario changed its rules, listings have dropped sharply.

There are other cities outside Ontario and British Columbia where money can go to, but after a similar move in Vancouver, only Montreal can sustain house prices gains. Perhaps house prices will fall nationwide.

In this case, the Canadian economy could suffer. Nevertheless, Canadian banks are much more resilient than American ones were before the crash. So, a bust could postpone a rate hike and weigh on the C$, but not trigger a huge crash.

More: CAD: Bringing Forward Our BoC Hike Call To Q4; Where To Target? – CIBC