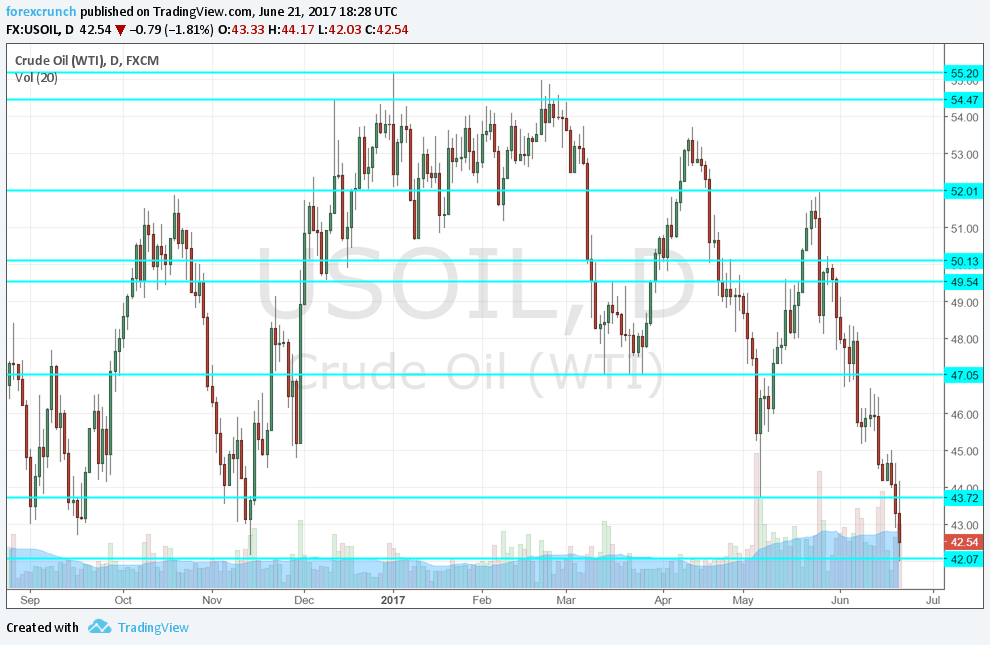

The low of November 14th, 2016 was $42.07. The low today was $42.03. This is as close to a perfect bounce off support. The price reached the lowest since August but by a mere 4 cents.

Can oil prices still make the break? Sure. The fall is backed by fundamentals.

Oil prices are falling as supply is greater than demand. This has been the story since late 2014. The more recent story is a failure of OPEC to cut supply.

Why oil is falling

First, OPEC agreed to make two troubled countries exempt. Libya is a divided country since its civil war in 2011 and production dropped very sharply. However, despite the country being split, oil production is increasing from the lows.

Nigeria is Africa’s most populous country and suffers from insurgencies as well as uncertainty about the health of the president. Yet also here, Nigeria is enjoying the exemption to export more oil.

All in all, OPEC’s actual production cuts are undermined by these two countries. Saudi Arabia is doing most of the work and it just had its own internal changes.

The root cause for the fall in oil prices comes from US shale production When prices were lower for longer, output eventually fell. However, the industry did not collapse. And when prices were higher for longer, output gained ground. And this time, the break-even levels for US producers are higher.

The latest trigger for the fall comes from various OPEC members, scrambling to talk about new cuts. This is a sign of worry, or even panic.

CAD showing strength

The Canadian dollar is influenced by oil prices. Clearly, Canada’s commodity causes the currency to move. However, the reaction in the C$ is limited. This reflects the strength of the loonie.

The Bank of Canada recently changed its stance to hawkish amid stronger growth rates. And apparently, Canada is not only about crude.

USD/CAD topped 1.33 and trades at 1.3310. However, it maintains a very safe distance from 1.3380 which was a clear level of support before the collapse.

So, if oil prices recover, we can expect the C$ to follow. A strong currency takes advantage of good news and ignores bad news.

WTI Crude oil technical levels

If we get a confirmation about the breach of $42, the next level to watch is the very round $40 level. This is were talk of new cuts could intensify. It could prove an important line regardless of technical indicators.

Below, we find $37.80 which worked as support in the past, followed by $35 and $30.

On the upside we are at more familiar levels: $43.70 which was a recent low in May. $47 was a tough line on the upside. Further up, $49.50 precedes the $50 level.