The Australian dollar suffers from election uncertainty and credit rating warnings. It can go even deeper. Here is the view from Deutsche Bank:

Here is their view, courtesy of eFXnews:

As the dust falls on political events in Europe and investors look up, the case to be short AUD is even stronger than before.

Domestically, the political gridlock that will likely result from Saturday’s inconclusive elections could have two consequences.First, it makes corporate tax cuts less likely and could dampen business confidence. Second, Australia now looks set to lose its AAA credit rating, which already started with S&P lowering its outlook on the country’s debt to negative.

Externally, China’s systematic devaluation in the past weeks has not yet raised alarm bells. However, Chinese devaluation should renew the pressure on the commodities complex. A weaker RMB lowers breakeven prices for Chinese high-cost producers and thus delays necessary supply-side adjustments.

As a consequence, we continue to see iron prices falling to the low $40s in the second half of the year to equilibrate the market. All things constant, this move alone would be worth ~3% downside in AUD/USD.

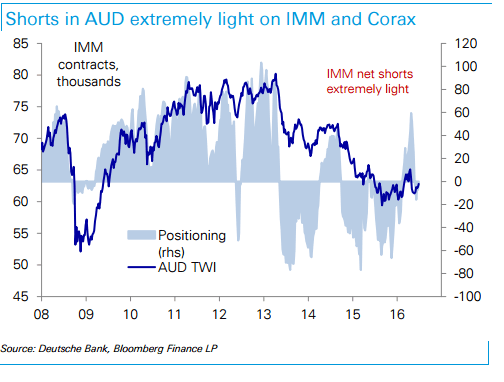

Net positioning is short again but is still extremely light both on IMM and Corax (chart 2). Moreover, valuation remains favourable with the REER and AUD/USD 13% and 7% above PPP, respectively.

We remain short against a basket of USD, EUR and JPY, and continue to target parity in AUD/NZD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.