- Chainlink 2.0 introduces new features that aim to redefine the future of the ever-growing DeFi and NFT industries.

- Chainlink is enabling enterprise adoption of its blockchain network by allowing users to build smart contracts in accordance with regulations.

- The oracle-based token is in price discovery mode, after reaching a record high at above $44.

Chainlink has released a whitepaper outlining its plan to create the next generation of decentralized oracle networks.

Chainlink to build an off-chain oracle network

In the past few years, Chainlink emerged as the industry-standard data source for the DeFi industry, connecting blockchains to external resources, including price data.

The DeFi industry currently sits at almost $60 billion in total value locked (TVL). Co-founder and CEO of Chainlink, Sergey Nazarov believes that the industry could reach a whopping $500 billion in TVL this year. The Ethereum-based network has been widely used as a decentralized oracle solution in sectors including NFTs as well.

Chainlink 2.0 aims to tackle seven key areas, including hybrid smart contracts, reducing complexity, scaling, confidentiality, fairness for transactions, minimizing trust, and incentive-based security.

The new whitepaper published by Chainlink highlights the evolution of hybrid smart contracts, which combines blockchain smart contract capabilities with off-chain world’s proof and data and computations. According to Nazarov, this step is a “big leap forward because it redefines what people can build.” He stated:

Oracle networks go far beyond delivering highly validated data, they provide the various decentralized services that are combined with smart contracts to create real world outcomes. These hybrid smart contracts are already redefining our industry as DeFi.

Hybrid smart contracts are nothing new. Nazarov stated that hybrid smart contracts are already used by stablecoin provider Paxos, which uses Chainlink for price data and proof of reserves. Chainlink 2.0 will allow more services to be available to DeFi projects, to enable people to build more advanced smart contracts, enabling further growth of the decentralized finance industry.

The blockchain industry is yet to evolve into being about many more things other than Bitcoin and tokens. With, Chainlink 2.0 hybrid smart contracts will also lead to the concept of Decentralized Oracle Networks (DON), which will support an unlimited number of functions.

DONs will operate off-chain, where data related to the smart contracts is stored and computed off-chain prior to the oracle making an input on the blockchain, triggering the smart contract’s outcome. Nazarov explained:

We’re evolving from simpler oracle networks into more advanced Oracle networks called DONs, and then a large collection of DONs will form a MetaLayer.

The MetaLayer enables an abundance of off-chain resources, including higher-frequency updates for price feeds, and security for NFTs. users will be able to get identity data into their smart contracts, allowing them to build smart contracts in accordance with regulations, enabling enterprise adoption.

The oracle-based blockchain company aims to increase services and users, and even introduced “super-linear staking,” for creating better crypto-economic security.

Chainlink in price discovery mode

Chainlink’s LINK token has broken into the top ten cryptocurrencies by market capitalization in the past three years. With recent competition among the top altcoins, Chainlink has fallen to the eleventh largest crypto by market cap.

Despite dropping out of the top ten, Chainlink price has managed to climb to a record high in the past 24 hours, reaching $44.15. Behavioral analytics firm Santiment revealed data that shows that more retail investors are holding LINK, as the total amount of tokens held by whales dropped to 64.3% from 68.7% six months ago.

Chainlink supply held by addresses

Chainlink’s social volume spikes also coincided with LINK price. Santiment’s data shows that the social volume spiked when Chainlink released its new whitepaper.

Chainlink social volume

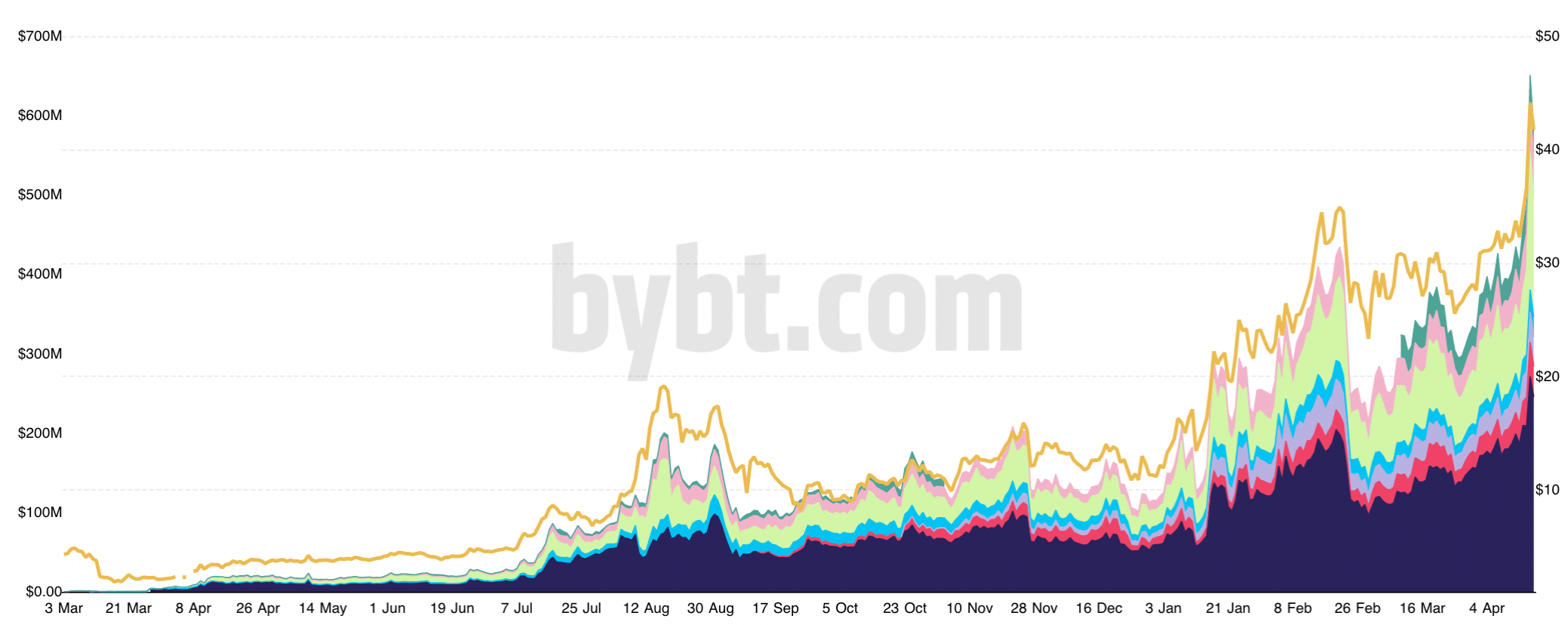

While the price of LINK continues to push higher and DeFi applications taking center stage, Chainlink’s future open interest also reached a record high at above $650 million.

Chainlink futures open interest

At the time of writing, Chainlink price is trading steadily above $40 at $41.79, with a 2.9% profit in the past 24 hours. In the past month, LINK price has climbed roughly 50%.

%20%5B10.03.01,%2016%20Apr,%202021%5D.png)