- Chainlink is down more than 20% since the start of the week.

- Several strong resistances are located just above the price.

- Next significant support for LINK is located around $23.

Chainlink suffered heavy losses at the start of the week and failed to shake off the bearish pressure. Following a recovery phase on Wednesday, the bearish momentum gathered strength, once again, and forced LINK to extend its weekly slide. As of writing, Chainlink was trading at $25.30, losing nearly 26% on a weekly basis.

Near-term outlook to remain bearish if LINK fails to reclaim $30

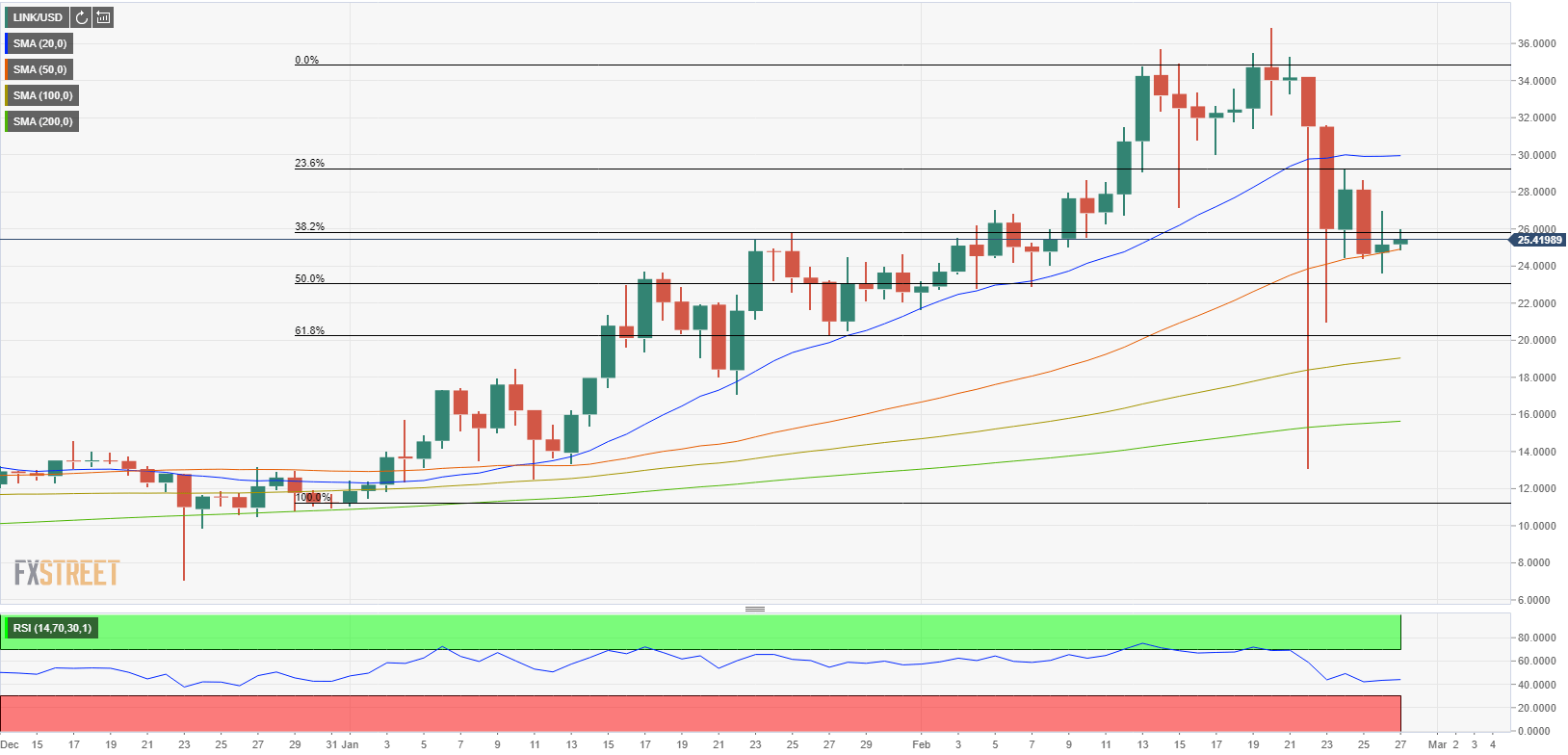

Despite the huge drop witnessed earlier in the week, the Relative Strength Index (RSI) on the daily chart holds near 40, suggesting that there is more room on the downside before LINK becomes technically oversold. The initial support is located at $2, the Fibonacci 50% retracement level of the rally seen during the first half of February. A daily close below that level is likely to open the door for additional losses toward $20 (psychological level, Fibonacci 61.8% retracement) and $19 (100-day SMA).

Resistances are located at $26 (Fibonacci 38.2% retracement ahead of $29 (Fibonacci 23.6% retracement) and $30 (psychological level, 20-day SMA).

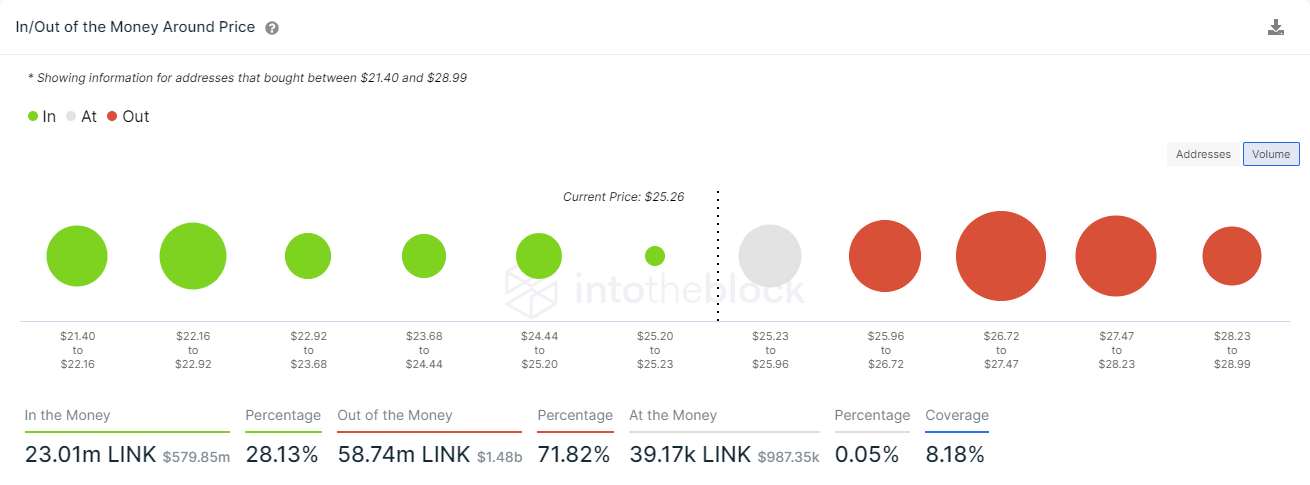

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model confirms that the next significant support area is located a little below $23 with more than 11K addresses purchasing nearly 8.7 million LINK around that price.

On the upside, several strong resistances seem to have formed between $26 and $28, suggesting that buyers are unlikely to show interest in Chainlink unless the price clears that area.

LINK IOMAP chart

Although Chainlik was able to pull away following Monday’s unprecedented slump, the near-term technical outlook and on-chain metrics show that sellers remain in control of the price action. The next leg down could drag the price lower toward $20 and only a daily close above $30 could attract buyers.