- Chainlink price slides below the 200-day SMA to drop 24% over the last 7 days.

- Overcoming the 200-day SMA at $28 will bolster LINK to revisit the June 23 range high around $32.85.

- Chainlink upwards movement to be bolstered by such developments as Cell Land Integrating Chainlink Price Feeds on its platform.

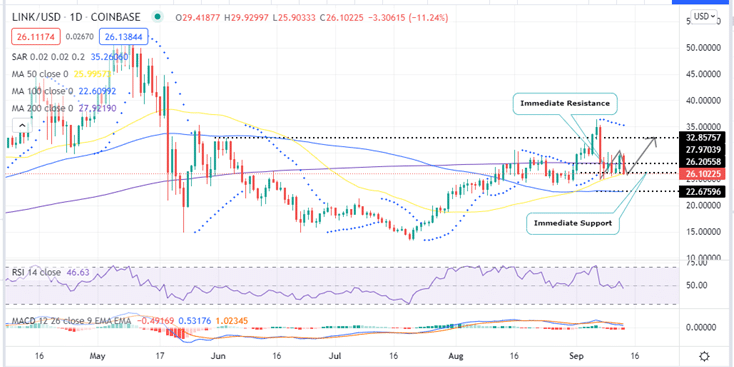

Chainlink price is currently changing hands at $26.10 down 5.23% in the last 24 hours as bears are determined to push it below the 50-day Simple Moving Average (SMA) around $26. During the Tuesday crypto market flash crash, LINK fell approximately 20% to close the day around at the 200-day SMA around $28. The flash crash saw Chainlink lose as much as 28% to lows of around $25.

- Are you new to crypto trading? This guide on the best cryptocurrency to buy is a good place to begin

So, what was the week like for Chainlink?

Chainlink Price, The Week That Was

Chainlink price rose by approximately 30% in the week ending September 05. Significantly better that the 8% drop witnessed the previous week. Chainlink closed Sunday September 05 in the green at $33.53.

Chainlink price started the week on trading in the green as the bulls pushed the oracle cryptocurrency above the June 23 range high at $32.85 closing the day at $34.89 on Monday.

Tuesday’s crypto market flash crash saw Chainlink price drop below the 200-day SMA at $28.0 to record a low of $25.0 at the 50-day SMA. A drop of this magnitude meant that the sellers were significantly controlling LINK. However, the long lower wick on Tuesday’s candle shows that the bulls were not ready to let go of the support provided by the 200-day SMA as LINK closed the day on Tuesday just above this level.

The bearish leg continued on Wednesday which saw LINK slide below the 200-day SMA to seek support at the 50-day SMA around $25. LINK has been trading in alternating bearish and bullish sessions between Thursday and Saturday while recording higher. Chainlink price displayed two straight bullish sessions between Saturday and Sunday which pushed it above the 200-day SMA but today’s bearish session has brought it back below this crucial support again. At the time of writing, Chainlink is trading at $26.10.

During this week LINK dropped 24%, lost the $30.0 crucial support and flipped the 200-SMA at $28.0 from support to resistance. This has been the week’s downside.

LINK/USD Daily Chart

Chainlink price, The Week Ahead

The Chainlink price prediction for the week ahead is bullish as it targets the June 23 range-high above $32.85.

Note that if Chainlink closes the day above immediate resistance at $28 (200-day SMA), the asset could jump above $30.0 psychological level after which a push to the June 23 range high around $32.85 would be the next logical move. This would represent almost a 25% rise from the current price.

This bullish outlook is accentuated by the Movign Average Convergence Divergence (MACD) indicator is moving above the zero line in the positive region. This is an indication that the Chainlink market momentum is bullish in the long-term.

However, at the moment things look awry for Chainlink. A daily closure below the 50-day SMA at $26.20 could see LINK tag the 100-day SMA at $22.67.

This bearish outlook is accentuated by the nose-diving Relative Strength Index (RSI) indicator towards the oversold region. This is an indication that the bears are currently in control of the Chainlink price. Morover, the negative parabolic SAR and the movement of the MACD line (blue) below the signal line (orange) shows that the current market momentum is bearish.

Positive Fundamentals to increase Chainlink price buyer appetite

A part from the position of the MACD above the zero line, the robust downward support provided particularly by the 50- and 100-day SMA as seen on the daily chart shows that Chainlink’s long-term price prediction appears bullish.

In addition, positive fundamentals such as increased institutional adoption of cryptocurrencies may increase LINK price buying appetite. For example, Ukrainian parliament has passed a bill legalising and regulating cryptocurrencies in the country. This is an important step for the European country as it provides official clarity on the digital assets and which was in a grey area previously.

Moreover, other developments on the Chainlink platform are likely to boost the price. These include:

- Cell Land, an Decentralized NFT-based billboard, is Integrating Chainlink Price Feeds on Ethereum to help fix the price of its native tokens. This will enable users to purchase pixels and rent out pixel space on the billboard for a fixed amount of stablecoins.

- DeXeNetwork, a social trading platform has integrated Chainlink Price Feeds to help users to easily track asset prices, follow trades, and calculate returns. DeXe is also integrating Chainlink Keepers to enable limit order functionality, increasing the utility of the Chainlink platform

- Cardence, A launchpad platform, plans to enhance its platform with multiple Chainlink oracle services. This is expected to provide secure and accurate exchange rates for crypto-to-crypto transactions. Cardence is also integrating Chainlink VRF to allow for fair whitelisting and reward distributions that can be easily proved.

- Decentralized lending protocol, Creamdot Finance, has integrated Chainlink Price Feeds into its platform to allow its users to obtain a secure and reliable source of financial market data on the native tokens of Axie Infinity and Yield Guild. This provides the all-needed bridge between the DeFi ecosystem and the emerging Metaverse.

Where To Buy LINK?

If you wish to buy cryptocurrencies including Chainlink, crypto exchanges such as eToro , Binance, Coinbase, Bittrex and Kraken are good places to visit.

Looking to buy or trade Chainlink now? Invest at eToro!

Capital at risk