The report that China will slow or halt purchases of US bonds sent the dollar tumbling down across the board. The moves are quite significant and we are seeing nice reversals.

We noted that EUR/USD has an impressive technical behavior so far in 2018. The world’s most popular currency pair seems to respect technical levels to a great degree.

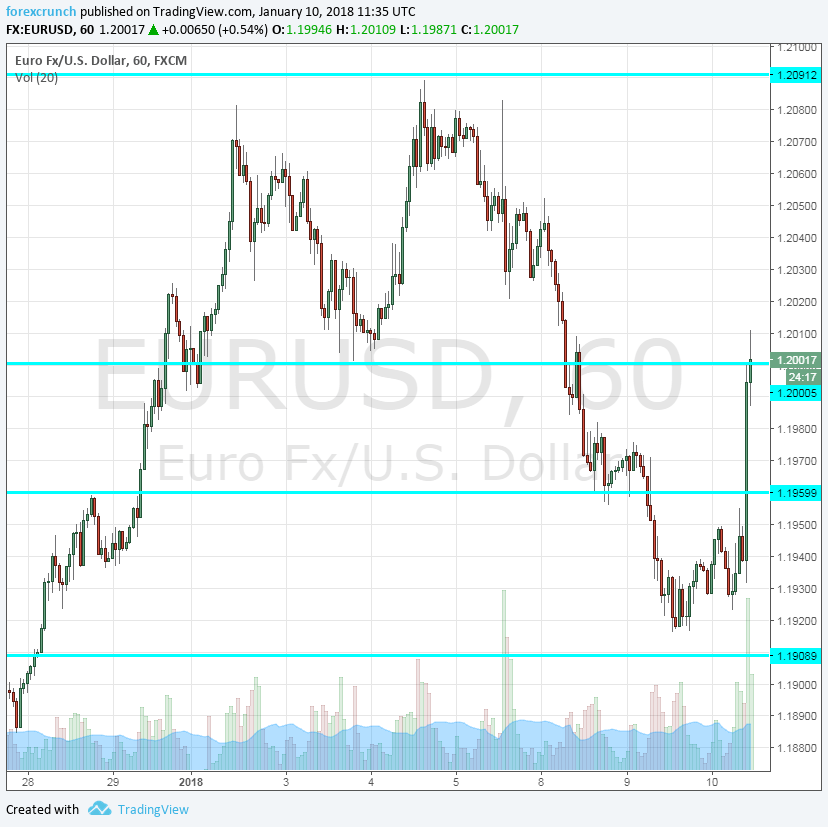

This good behavior is also seen now. The breaking news out of China was enough to send euro/dollar above one resistance line, 1.1960, quite swiftly. The low of the day was 1.1923 and the pair was capped under that level before the news broke out.

But so far, the news was not strong enough to send Euro/USD above 1.20. Sure, the high was 1.2010, but that was quite temporary. After the initial move, the pair is trading under that round number.

What’s next? We are still waiting for an official confirmation or rejection from the authorities in China, the world’s second-largest economy. A confirmation could push the pair above 1.20 and towards the next cap at 1.2090, the 2017 high. A denial of the Bloomberg report could send euro/dollar back down towards 1.1960, and then 1.1910.