According to a report by Bloomberg, China is considering a halt or at least a slowdown in buying US treasuries. The report cites people familiar with the matter, saying that US government bonds are becoming less attractive in comparison with other assets. Perhaps worse off, they also cite trade tensions with the US as a reason for the decision. Is this the start of a trade war?

Apart from the directly-linked sell-off in Treasuries and the consequent jump in yields to around 2.58%, the US dollar is falling across the board.

- EUR/USD is topping 1.20 after falling below the level and only finding support at the low line of 1.1910. The technical behavior of EUR/USD is impressive. The next level of resistance is 1.2090, the 2017 peak. More: Chinese USD Crash: EUR/USD jumps over one resistance line, halts at 1.20 for now

- GBP/USD jumps above 1.35 after losing the level on mediocre data earlier on, trading at 1.3550. Resistance is at 1.3615.

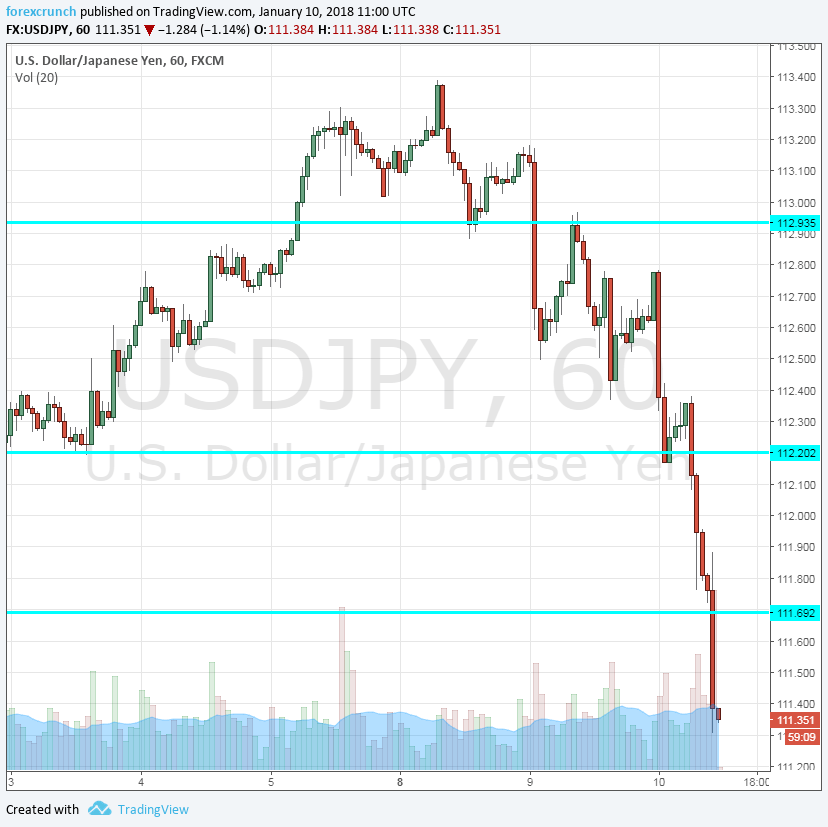

- USD/JPY extends its falls to 111.30. The potential for monetary tightening in Japan had already pushed the yen higher yesterday. 110.90 is the next level of support.

- USD/CAD is at 1.2430. The Canadian dollar also enjoys the excellent Canadian jobs report, a bullish BOC report, and rising oil prices. 1.24 awaits as a cushion.

- AUD/USD rises to 0.7860. The round number of 0.79 is next up. Support is at 0.7840.

US bond yields were already on the rise before the news came out from China. Some expect inflation to finally pick up with GDP and employment growth. Bill Gross and Jeffrey Gundlach, two “bond kings” have commented on rising yields, analyzing if the mutli-decade bond market has come to an end.

More: Best cryptocurrency to invest in 2018

Here is how it looks on USD/JPY: