Here’s what you need to know on Wednesday

Markets:

The BTC/USD is currently trading at $8,630 (+2% on a day-to-day basis). The coin has retreated from the intraday high of $8,899, though the short-term trend remains bullish.

The ETH/USD pair is currently trading at $161.8 (+9% on a day-to-day basis). The Ethereum retreated from the intraday high of $171.67; now, it is moving within a short-term bearish trend amid shrinking volatility.

XRP/USD settled at $0.2345 after a spike to $0.2427 during early Asian hours on Wednesday. The coin has gained over 7% in recent 24 hours.

Among the 100 most important cryptocurrencies, the best of the day are Bitcoin Gold (BTG) $14.63 (+83.5%), Bitcoin SV (BSV) $356.15 (+76.5%) and Bitcoin Diamond (BCD) $0.6398 (+52.1%), The day’s losers are, ABBC Coin (ABBC) $0.1029 (-11%), MaidSafeCoin (MAID) $0.0923 (-8.9%) and Nexo (NEXO) $0.1023 (-2.6%).

Chart of the day:

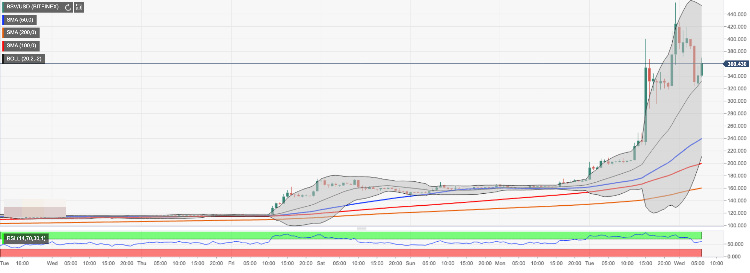

BSV/USD, 1-hour chart, Head-and-Shoulder pattern

Market:

Bitcoin SV is now the fourth largest digital asset with the current market value of $6.1 billion. The coin hit the high of $448 on Tuesday before retreating to $352 by the time of writing. Despite the retreat, it is still nearly 70% higher from this time on Tuesday. Since the beginning of the year the coin has more than tippled its value. The new developments in Wright vs. Kleiman case may have triggered the massive pump.

A stellar growth of top cryptocurrencies lent support to decentralized finance (DeFi) applications as traders rushed to capitalize on the market spike. According to Robert Leshner of Compound Finance, traders turned to DeFi solutions to speculate on the market movements. The data provided by DeFi Pulse revealed that the value of ETH locked into those apps spiked from roughly $706 million on Monday to $782 million on Tuesday.

Industry:

The US-based cryptocurrency exchange acquired an Australian trading platform for digital assets, Bit Trade. The platform has been operating since 2013, providing traders with access to bitcoin and a number of other popular cryptocurrencies. Bit Trade supports various deposits methods including debit and credit cards and operates a multi-exchange aggregator that combines local and global exchanges into a single interface. The acquisition marks Kraken expansion to Australia.

OKEx now allows users to trader its native OKB token against EUR. OKB/EUR market is launched on Bitlocus, a European cryptocurrency exchange startup. Currently, OKB can be traded against several fiat currencies, including US dollar, the South Korean won, the Vietnamese dong, the Indonesian rupiah, and the euro. The token provides its holders with several privileges, such as better trading fees and higher subscription limits in token sales run on OKEx.

Regulation:

The Securities and Exchange Commission (SEC) in the US explained why investments in Initial Exchange Offerings (IEO) may be risky. The Agency believes that the majority of IEOs are conducted with gross violations of the Securities law. Also, the SEC emphasized that unregulated exchanges cannot provide the required level of investor protection. Currently, no platform obtained a regulatory permission required to conduct an IEO on the territory of the United States.

Crypto asset manager Bitwise decided to withdraw its proposal to list a physically-backed Bitcoin investment vehicle on NYSE Arca. Initially, the company planned to launch a regulated ETF that would track its Bitwise Bitcoin Total Return Index. That was the second attempt to get the regulatory permission for a physically-backed ETF. The first proposal was rejected by SEC in October. After that Bitwise tried to address the regulator’s concerns, but, apparently, failed to satisfy SEC’s demands.

Quote of the day:

BTC/USD: We may have broken out of the downwards channel – likely resistance at $9,000.

Tuur Demeester, Founding Partner Adamant Capital