Here’s what you need to know on Friday

Markets:

The BTC/USD is currently trading at $8,900 (+2.8% on a day-to-day basis). The coin sett a new 2020 high and stopped within a whisker of critical $9,000.

The ETH/USD pair is currently trading at $168.0 (+4.46% on a day-to-day basis). Ethereum retreated from the intraday high of $171.08; now, it is moving within a short-term bearish trend amid expanding volatility.

XRP/USD settled at $0.2325 after a spike to $0.2361 during early Asian hours. The coin is up 3% in recent 24 hours.

Among the 100 most important cryptocurrencies, the best of the day are Ethereum Classic (ETC) $9.96 (+30.5%), MonaCoin (MONA) $1.22 (+24.57%) and Cosmos (ATOM) $4.96 (+14.16%), The day’s losers are, Swipe (SXP) $1.28 (-13.5%), Centrality (CENNZ) $0.0785 (-9.18%) and Seele (SEELE) $0.1189 (-8.95%).

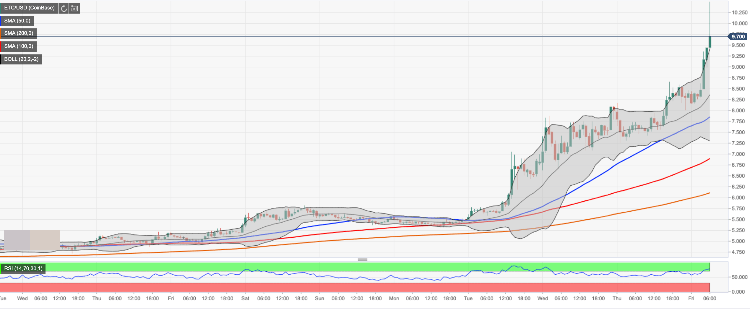

Chart of the day:

ETC/USD, 1-hour chart

Market:

The former head of the US Commodity Futures Trading Commission (CFTC), J. Christopher Giancarlo has joined the Digital Dollar Foundation. The project is focused on creating a digital dollar and promoting the idea of digitizing the U.S. dollar. The ex-CFTC Chairman will explore the prospects of turning US Dollar into “fully electronic currency based on blockchain currency”.

TRON’s founder Justin Sun announced the creation of stablecoin based on TRX and BBT and asked Twitter community to find the best name for a new coin.

#TRON community will launch a new decentralized stablecoin backed by $TRX & $BTT. What’s the best name for this stablecoin?

Industry:

Criminals moved $2.8 billion worth of cryptocurrency to exchanges in 2019, the recent report of Chainalysis showed. The cryptocurrency research company found out that over-the-counter (OTC) platforms played a significant role in money laundering activities. Moreover, over 50% of the above-said amount went to Binance and Huobi.

Financial advisors increasingly consider cryptocurrency investments for their customers, according to the recent research conducted by the cryptocurrency investment firm Bitwise Asset Management. They surveyed over 400 financial advisors and revealed that 13% of them were allocating funds in cryptocurrency assets for their clients in 2020 against 6% in 2019. High returns were cited as a may reason for choosing digital assets.

“The return characteristics are hard to ignore. It’s really hard to find assets not correlated with stocks and bonds that have the potential for higher returns that anyone can access,” Matt Hougan, Bitwise managing director, commented.

A subsidiary of Yahoo Japan, Z Corporation, and a Japanese licensed cryptocurrency exchange, TaoTao, are negotiating a strategic partnership deal with Binance in the Japanese market. The parties will collaborate with the Japanese financial regulator, Financial Service Agency to ensure full regulatory compliance.

Regulation:

The UK High Court dismissed the lawsuit filed by Craig Wright against Twitter user known as Hodlonaut as it has no jurisdiction. Now the parties are going to meet in a Norwegian court. Craig Wright accused Hodlonaut of slander and filed a lawsuit against him. This event led to a big scandal, which resultd in massive delisting of Bitcoin SV from major cryptocurrency exchanges.

UK High Court handed down judgment today in the defamation case CSW filed against me. The Judge ruled UK does not have jurisdiction, and the proceedings against me there to be dismissed. Norway has jurisdiction. We will go to court there to put an end to this mess.