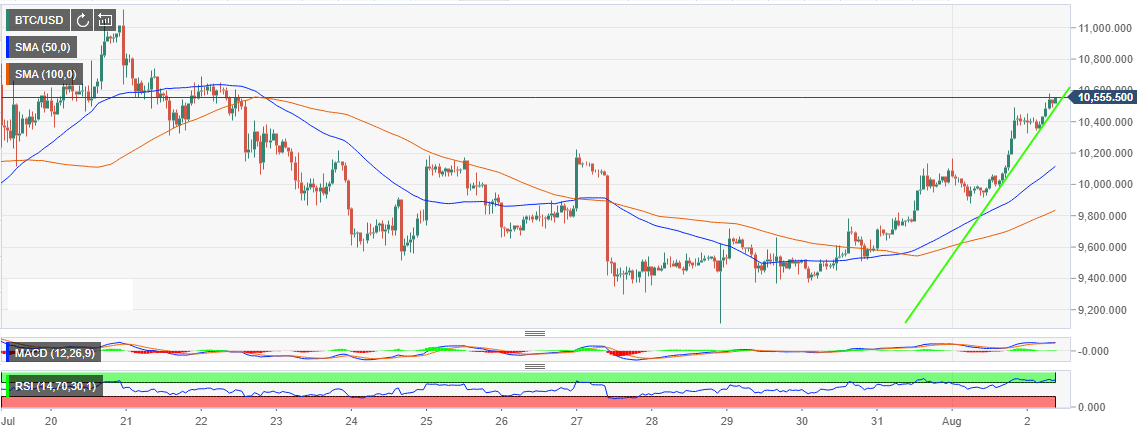

Bitcoin market update: BTC/USD bulls defiantly push towards $11,000

The cryptocurrency market stays in the green as week’s trading grinds to a halt. After opening the week amid negative volatility, Bitcoin buyers focused on higher levels. The phenomenon recovery gave Bitcoin a kick above the 50 Simple Moving Average (SMA) 1-hour chart and later the 100 SMA 1-hour.

Overcoming the hurdle at $9,800 allowed Bitcoin to set eyes on $10,000 and higher levels. The price action progressed above $10,200 before tackling $10,500 resistance. At the moment, $10,600 remains unconquered.

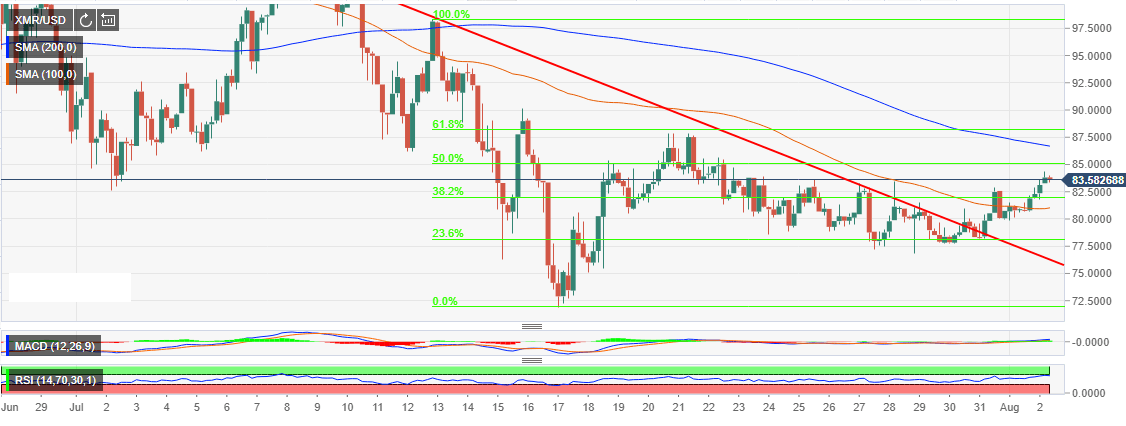

Monero price analysis: XMR/USD bulls fight to hold onto the intraday gains

Monero is in the green amid a sea of red. The cryptocurrency market is making a correction after formidable gains on Friday during the Asian hours. Like Bitcoin which soared above $10,500, Monero made a shallow rise from the opening price at $82.36 to a high at $84.33. Monero is among the few digital currencies that are holding on to the intraday gains.

At the time of writing, Monero is teetering at $83.52 following a 1.3% rise on the day. Glancing north, the immediate resistance is at the 50% Fibonacci retracement level taken between the last swing high at $98.35 to a swing low of $72.01. Correction above the 50 Simple Moving Average (SMA) will pave the way for gains towards $100.

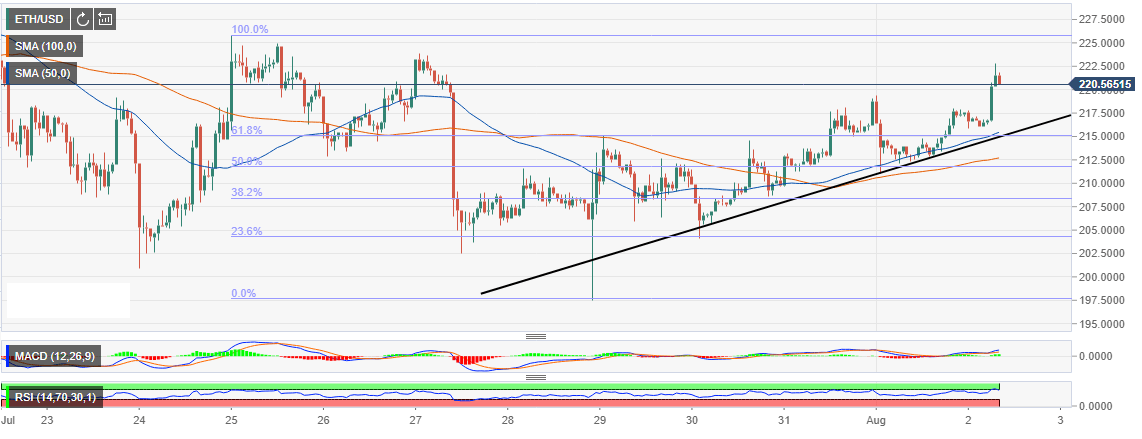

Ethereum price analysis: ETH/USD end week surge settles above $220

Ethereum embarked on an impeccable journey of breaking barriers on Friday. Following the extreme selling extravaganza last week, ETH/USD found support at $197. This gave way for a rebound above $200 and later retraced past the 61.8% Fibonacci retracement level taken between the last swing high of $225.84 to a swing low of $197.63.

After reclaiming the support at $220, Ethereum bulls gave the price a push to the intraday highs around $222.85. At press time, ETH/USD is struggling to hold above the critical $220. The prevailing trend is gradually turning bearish especially with the Relative Strength Index (RSI) having hit the overbought region. Retreat from the levels above 70 will encourage the bears to increase their grip.