Here is what you need to know on Monday, August 17, 2020.

Markets:

Bitcoin and other major cryptocurrencies are extending the mundane price action witnessed over the weekend. Particularly, Bitcoin was not able to overcome the resistance at $12,000 in spite of the multiple attempts witnessed.

BTC/USD is trading at $11,833 although it had traded a low around $11,775 on the day. The main focus is to hold above $11,800 and keep all eyes on $12,000. The dominating trend at the moment is bearish but low volatility means that price action will remain limited. As discussed earlier, analysts like PlanB are choosing to remain bullish despite the delay in breaking above $12,000.

Read also: Bitcoin Price Prediction: BTC/USD next target 2017 all-time high at $20,000 – analyst

Ethereum price has retreated from the new yearly high to seek support above $420. Weekend price action above $430 was unsustainable. Ether is trading at $424 following a 2.2% loss on the day. With support established at $420, a bullish momentum seems to be building amid expanding volatility.

Ripple’s price action from mid-June has been progressive. The growth in value June lows at $0.1686 to highs of $0.3250 has also been reflected in the increase of XRP’s market capitalization. XRP is back into its third spot according to CoinMarketCap; a position that was occupied by Tether (USDT) for some time this year. At the moment, XRP is trading $0.30 after recovering from $0.2974 (intraday low).

Most of the major coins in the market are dealing with an increase in selling activities. However, some coins with smaller market capitalizations are bullish at the time of writing. They include Aave (12.70%), Ontology (9.77%), Basic Attention Token (27%), OMG Network (51.66%), Ox (15.55%), Ren (24%) and yearn.finance (16.12%).

BTC/USD 4-hour chart

Market:

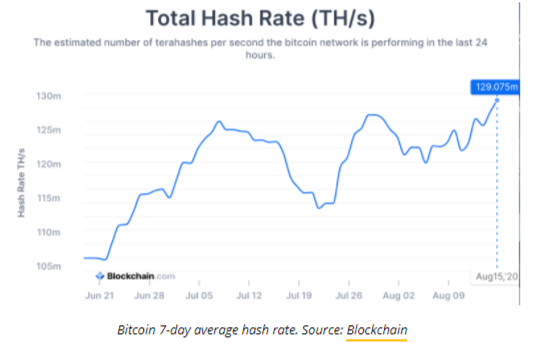

Bitcoin hash rate has hit a new all-time high even as the price hovers under $12,000. According to data by Blockchain.com, BTC seven-day average hash rate hit afresh peak clocking 129.075 EH/s. Prior to the breakout, the hash rate was relatively stable for about two weeks. The hash rate is a metric that shows the amount of computing power miners are channeling into the network in order to process BTC transactions. A high average indicates that miners are confident in mining profitability.

Industry:

BitPay, the largest cryptocurrency payments network in collaboration with Coinbase has launched a service that will see users spend funds directly from Coinbase accounts at all BitPay merchants and for zero fees.

The service also eliminates the need for peer-to-peer transfers because users can spend cryptocurrencies such as Bitcoin, Ethereum, Bitcoin Cash and USD Coin directly from the BitPay Wallet Apps. Transactions supported by this new service are those with a value of less than $1,000. According to Sean Rolland, the director of product at BitPay:

Customers who have a Coinbase account [and] are looking for a fast, secure and easy way to pay for goods and services with crypto globally now have additional options through BitPay enabled merchants.

Integration between Coinbase and BitPay lets users pay directly from their Coinbase account, opening up new global business opportunities to accept and pay with crypto.

Regulation:

According to George ball, the former CEO of Prudential Securities and currently the CEO of Sanders Morries Harris, Bitcoin is “very attractive” both in the long term and the short term. He added that the government in the US will eventually stop stimulating the markets and people will start looking into Bitcoin and other cryptocurrencies in order to deal the reduction in liquidity.

“The liquidity flood will end. Sooner or later, the government’s got to start paying for some of these stimulus, for some of the deficits, for some of the well-deserved, very smart subsidies that it’s providing to people. Are they going to raise taxes that high? Or if not, are they going to print money? If they print money, that debases the currency and probably even things like TIPS – treasury inflation-protected securities – can be corrupted.”

%20(25)-637332420835408686.png)