- Here is what you need to know on Friday, July 31, 2020.

Markets:

Bitcoin continues to hold above $11,000 despite the rejection of $11,200 on Thursday. The trend in the market is bullish as we usher in the European session but due to low volatility, upward action remains limited. BTC/USD is dancing with $11,065 after hitting an intraday high at $11,119.

Read more: Bitcoin Price Prediction: BTC/USD facing severe resistance at $11,047 – Confluence Detector

Ethereum is also slightly in the red after losing 0.54% of its value from an opening of $335. This followed a spike to $340 (new 2020 high) on Thursday. Resistance at $335 is giving buyers a hard time mainly because volatility is shrinking. ETH/USD is exchanging hands at $333 after establishing and confirming support at $330.

Read more: Ethereum Price Analysis: ETH/USD 5-year anniversary rockets it to new 2020 high at $340

Ripple, on the other hand, is relatively in the green having added a subtle 0.18% onto its value on the day. From the opening value of $0.2446, XRP is teetering at $0.2449. The main mission for the last couple of weeks is to break the resistance at $0.25 in a bid to boost the price above $0.30.

Some cryptocurrencies among the top 100 are performing incredibly well including VeChain (11.82%), Chainlink (7.7%), Flexacoin (7.82%), Bancor (20.17%) and Aragon (8.14%).

Chart Of The Day: BTC/USD daily

Market:

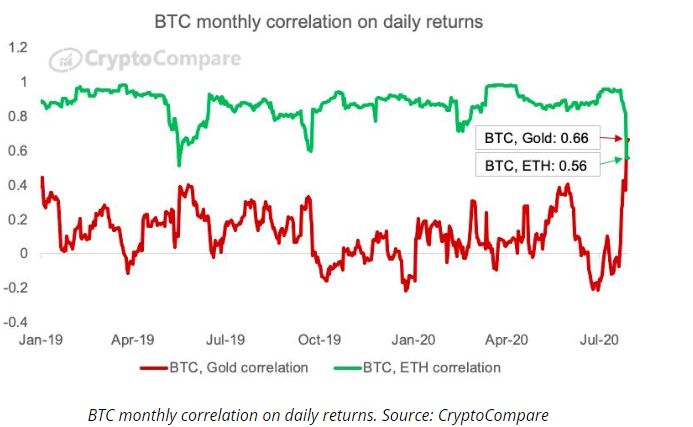

Bitcoin appears to have renewed its correlation with the precious metal, gold. At the moment, the largest cryptoasset correlation with hold holds at 0.66 as per data released by CryptoCompare. The correlation returned following gold’s massive breakout last week that sent it close to new highs. At the same time, Bitcoin price rallied significantly from a tight range ($9,000 – $9,300) to new 2020 highs at $11,400. Prior to this increase in correlation, the relation between the two assets had taken a big hit. According to James Li, a research analyst at CryptoCompare:

Last time Bitcoin had a moderate correlation with gold (around 0.5) was towards the end of 2018. That was when a month earlier in November 2018 bitcoin suffered a 50% drop (at the height of the bitcoin cash war) and made some subsequent rebounds. Gold was recovering from a somewhat cyclical drop a couple of months earlier. The moderate correlation back then was perhaps a bit of a coincidence.

Industry:

Cardano (ADA) is currently executing on the new Shelly mainnet following a successful hard fork. It has been reported that hundreds of stake pools started streaming into the network barely 24 hours after the mainnet. Users of ADA have the opportunity to hand over their holdings to the staking pool operators and in return, they will earn passive income.

At the moment, there are about 481 staking pools in the Cardano network. However, this number keeps changing. The testnet had about 1061 registered pools of which 986 were active. The number of staking pools is expected to continue growing in the coming months.

Quote of the day:

“Bitcoin is competing as money and not as stock or a token. Stablecoins, while they are easier to transfer than normal fiat in a bank, are still just tokens backed by fiat. Coins that do not use proof of work can be pre-mined, or are not actually scarce since no real work is required to produce them.” @Buy Bitcoin Worldwide founder Jordan Tuwiner.

%20(11)-637317735729649542.png)