Here is what you need to know on Friday, September 4, 2020.

Markets:

For two consecutive days, the cryptocurrency market has been in shambles. Data by CoinMarketCap highlights the selloff with a drop in the market cap from $389 billion to $336 billion. On the other hand, the increase in the trading volume shows that sellers have been on steroids.

Bitcoin has been at the forefront of these losses after dropping below $11,000 and extending the bearish action marginally under $10,000. At the moment, a shallow recovery has adjusted the price upwards to trade at $10,826. On the upside, resistance is envisage at $10,359 (intraday high) and $11,000.

Read more: Bitcoin Price Prediction: BTC/USD painful downtrend far from over, downside eyes $8,000

The smart contract giant, Ethereum is also nursing losses after diving from $489 (yearly high) to $370 in 48 hours. The first support at $420 held its ground but the rampant selloff in the market forced ETH downstream refreshing levels under $400. At the time of writing, Ethereum is trading $387 amid a push for recovery above $400.

The cross-border cryptocurrency, XRP is trading 1.95% higher on the day after recovering from $0.2445 (opening value) to $0.2493 (prevailing market value). XRP is the only major cryptocurrency trending upwards amid high volatility. This means that gains above $0.25 are likely to come into the picture in the short term.

The losses suffered by the major cryptos did not spare the altcoins. Some tokens were battered massively like Chainlink (-16.67%), Binance Coin (16.89%), Cosmos (18.40%), UMA (26.68%), VeChain (20.27%), Zcash (24.38%) and SushiSwap (-33.35%).

Chart Of The Day: BTC/USD daily chart

Market:

The week has been action-packed in the cryptocurrency space. First, Bitcoin stepped above $12,000 but failed to sustain the bullish action. The fall on Wednesday and Thursday saw the flagship crypto dive under $10,000 as described above. The quick pullback sent Bitcoin back to five-figures as it consolidated above $10,200. In spite of the recovery, many analysts and traders believe that Bitcoin is going to plunge further in a bid to close the recent Chicago Mercantile Exchange (CME) gap at $9,700. The gap comes into existence when the asset moves significantly during outside trading hours for CME Bitcoin Futures markets. The recent gap formed when Bitcoin lifted above $10,000 in mid-August.

CME Bitcoin Futures 4-hour chart

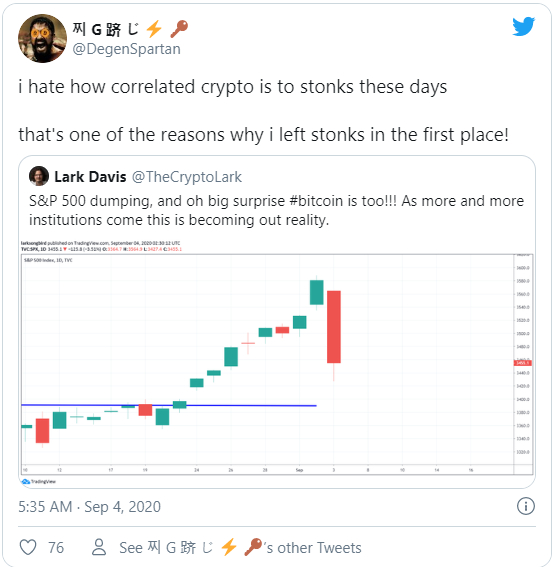

The market tends to correct downward to fill the gap that is left by the CME BTC Futures hence the likelihood of Bitcoin still diving closer to $9,700. It is good to note that some analysts are not buying the idea that the CME gap was the force behind the market crash. For instance, DegenSpartan (not his real name) wrote on Twitter that the recent crash is due to a high correlation between BTC and the leading stock assets such as the S&P 500.

Regulation:

The Governor of Britain’s Central Bank, Andrew Bailey in a webinar on stablecoins and central bank digital currencies on Thursday was rather cold towards cryptocurrencies in general. He said that despite Bitcoin being in existence for over ten years, it doesn’t have “any connection to money” and its “value can fluctuate widely and unsurprisingly.” As to whether Bitcoin and cryptoassets can be adopted as a means of payment, he reckoned that “they strike me as fundamentally unsuited to the world of payments where a certainty of value matters.”

Quote of the day:

“But if stablecoins are to be widely used as a means of payment, they must have equivalent standards to those that are in place today for other forms of payment types,” Andrew Bailey, Governor Britain’s Central Bank.

%20(32)-637347995559836110.png)