- Ripple bulls make a comeback after defending $0.28 short-term support.

- Bitcoin resurfaces above $8,000 ahead of a falling wedge pattern breakout.

- Ethereum impressively rises from the key support at $170 but the upside is capped under the descending channel.

The cryptocurrency market is unapologetically acting like a beast. It swings as it wishes in the most unexpected conditions. For instance, the market suffered under the bears’ wrath on Wednesday dropping from $222 billion to close the day at $216 billion. Intriguingly, a recovery led by Ripple has seen the market grow to $219 billion on Thursday during the European trading session.

Ripple market update

Ripple is grinding closer to $0.30 after testing the short-term support at $0.28. The 5% jump on the day comes as s surprise to many. Besides, in my earlier analysis I said that if Ripple breached the ascending channel support, chances of recovery will not only be minimal but also could cause breakdown towards $0.22.

Meanwhile, Ripple bulls are intent on seeing the price above $0.30. However, the hurdle at $0.30 is still proving to be a hard nut to crack. XRP is trading at $0.2955 as the bullish picture improves.

XRP/USD 60′ chart

Bitcoin market update

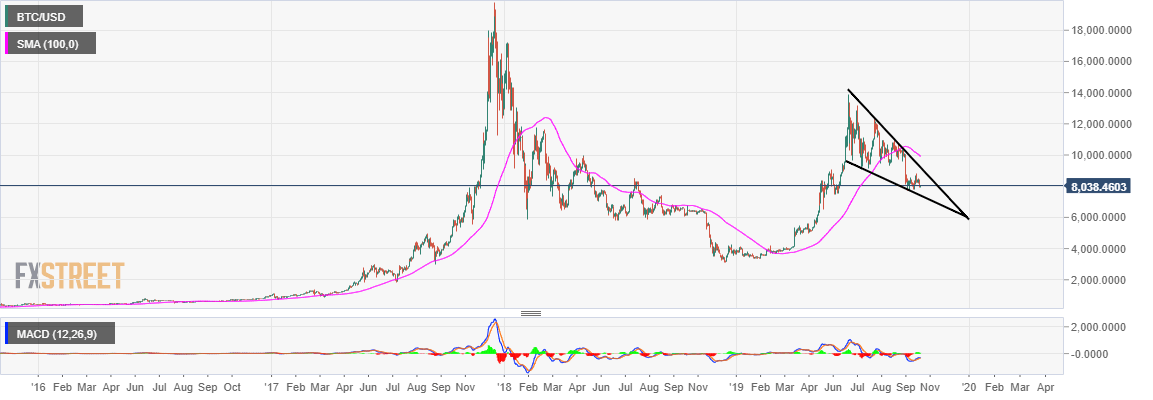

Bitcoin reacted positively by resurfacing above $8,000. The short-term technical picture appears very bullish but so is the long-term picture. As for the short-term, the Moving Average Convergence Divergence (MACD) is moving closer to the zero line. This suggests the bulls are present and ready to stir up action. From a long-term perspective, the forming falling wedge pattern suggests that a breakout is in the offing. This breakout is likely to have the magnitude to send BTC towards $10,000.

BTC/USD daily chart

Ethereum market update

Ethereum is currently flexing its muscles following a brief bullish wave across the market. The crypto remained suppressed during the Asian hours to the extent of approaching $170 for the first time in over a week. Impressively, recovery has been in play in the European session with the price rising above $176. The upside is capped by the descending trendline while the downside is strongly supported above $170.

%20(1)-637069007215085894.png)

-637069013451902667.png)