- Dash price has lost 15% of its value in the past 24 hours after a significant sell-off.

- Several on-chain metrics indicate the digital asset has more room to grow.

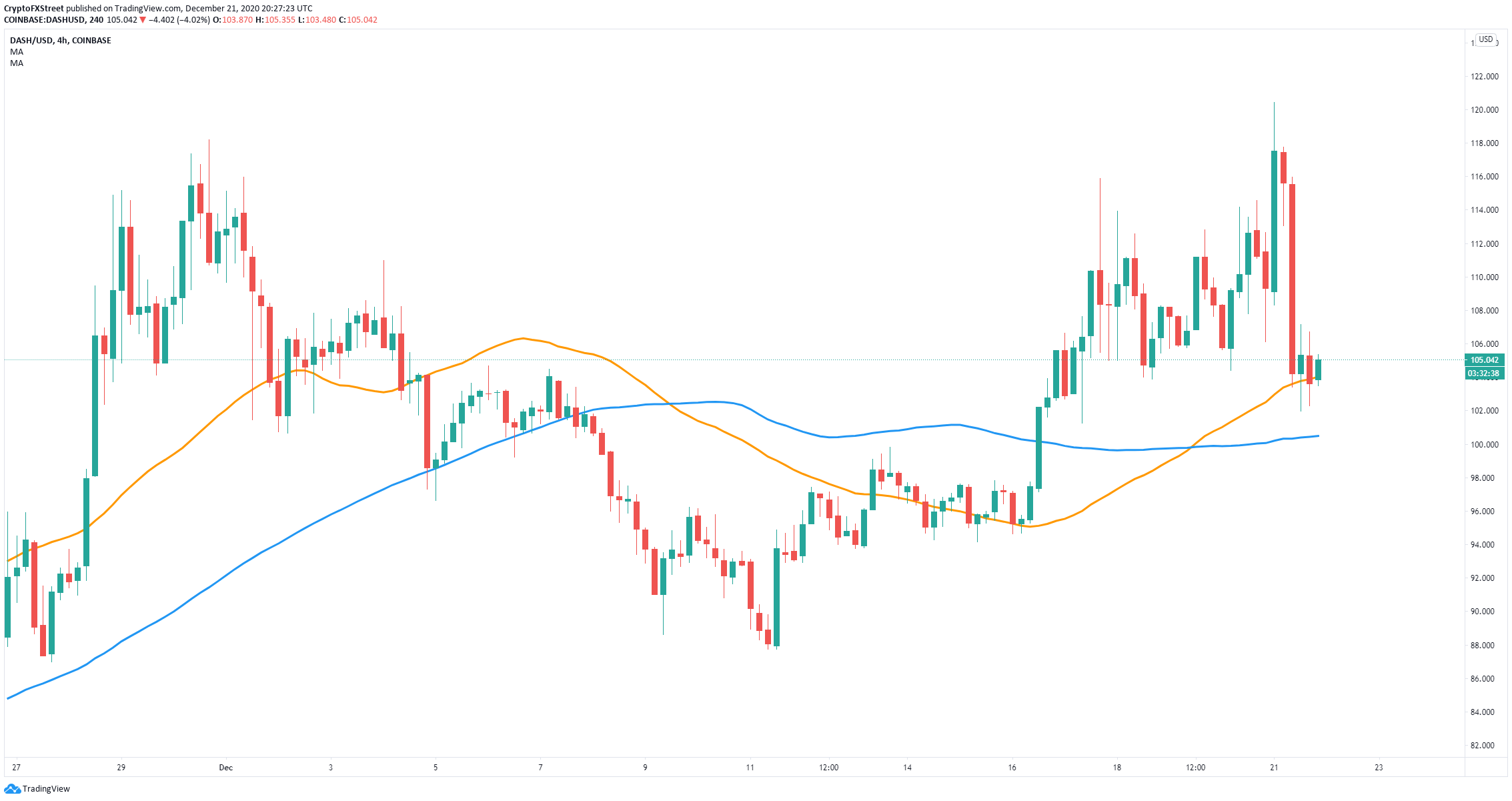

Dash was trading as high as $120 on December 21 before a massive sell-off down to $101.97. The digital asset is now trying to hold a critical support level to see a rebound as most on-chain metrics are still positive.

Dash price aims for a rebound towards $120

On the 4-hour chart, Dash price slipped towards the 50-SMA at $104 but managed to hold this critical support level for now. It seems that the digital asset is ready for a rebound as long as the bulls continue defending this level.

DASH/USD 4-hour chart

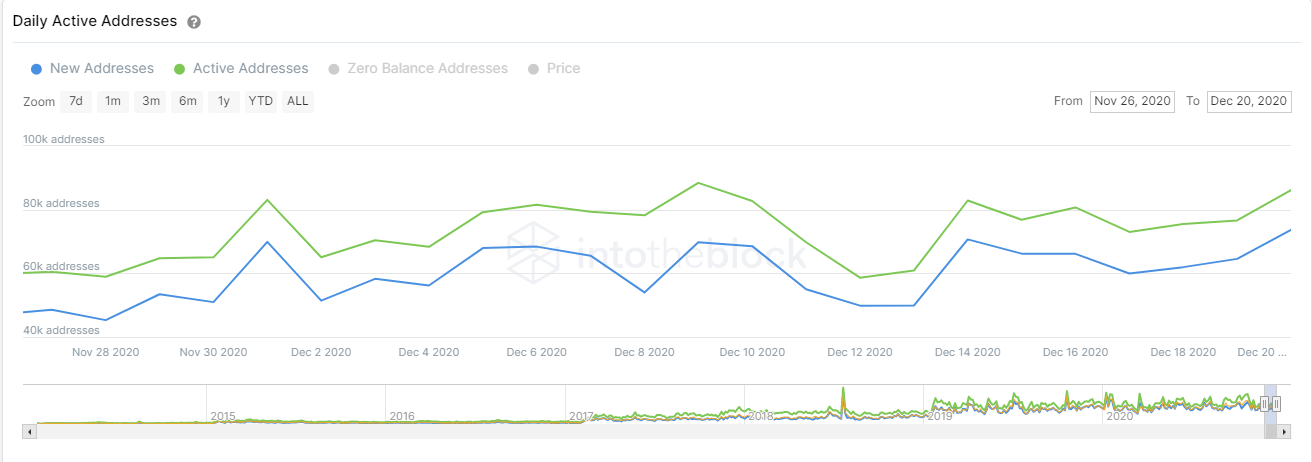

The number of new addresses and active addresses on the DASH network has increased by more than 40% in the past week. This metric has been in an uptrend since the beginning of December which indicates new and old investors are highly interested in the digital asset, adding buying pressure.

DASH new and active addresses chart

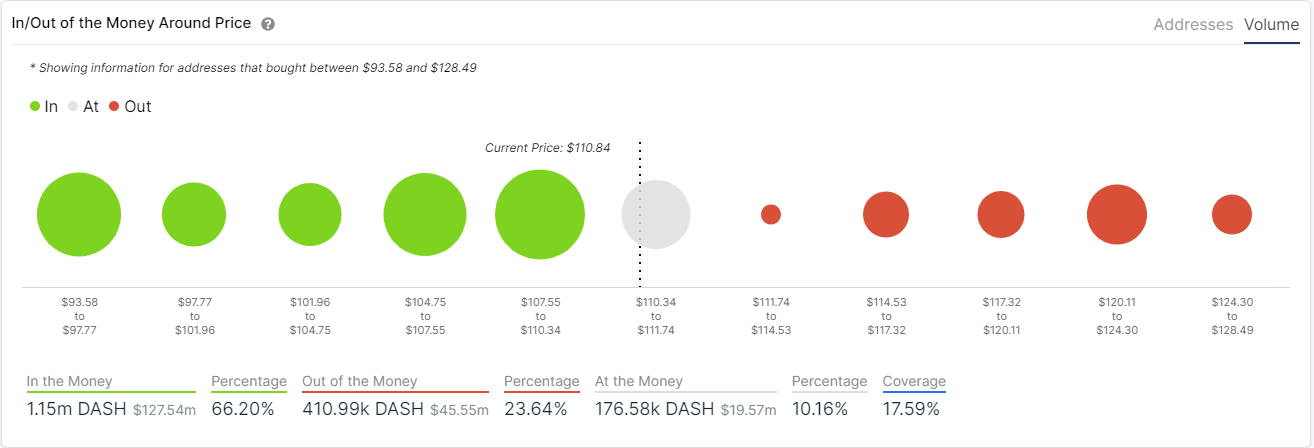

Additionally, the In/Out of the Money Around Price (IOMAP) chart shows very little resistance to the upside until the area between $120 and $124 which coincides with our price target. The most significant support range is located between $110 and $107 and there is a lot more support on the way down in comparison to the resistance above.

DASH IOMAP chart

However, despite the positive metrics, the digital asset could still slip further down if the 50-SMA support level is broken. A breakdown below this point can quickly push Dash price towards the psychological level at $100 which coincides with the 100-SMA.