- Swing trading strategies are useful in trending markets.

- Traders can apply them on long-term and intraday time frames.

Beginner traders are often overwhelmed by complicated technical analysis and multi-step trading strategies that require a profound knowledge of terminology, market mechanics and a lot of nuances. Instead, they look for something straightforward and simple to start with, just like swing trading.

Swing trading is an easy way to bet on the direction of the market move and an ideal strategy for newbies. The technique came from the traditional financial markets, like Forex and stocks.

This article contains useful and actionable information on how to swing trade cryptocurrencies and the essential things to consider before adopting this strategy.

What is swing trading based on?

The basic idea behind the swing trading strategy is to catch the price reversals and capitalize on price oscillations in the short and long time frames. It works the best on trending markets as it allows traders to identify the reversals and enter at the most favorable price.

How to implement a swing trading strategy

Below are some practical steps that will help grasp the idea of using the strategy. However, the best way to master the process is to practice as much as possible.

1. Identify the grand tend. First of all, the trader should identify a strong upside or downside trend on a higher time frame chart, for example, weekly or monthly.

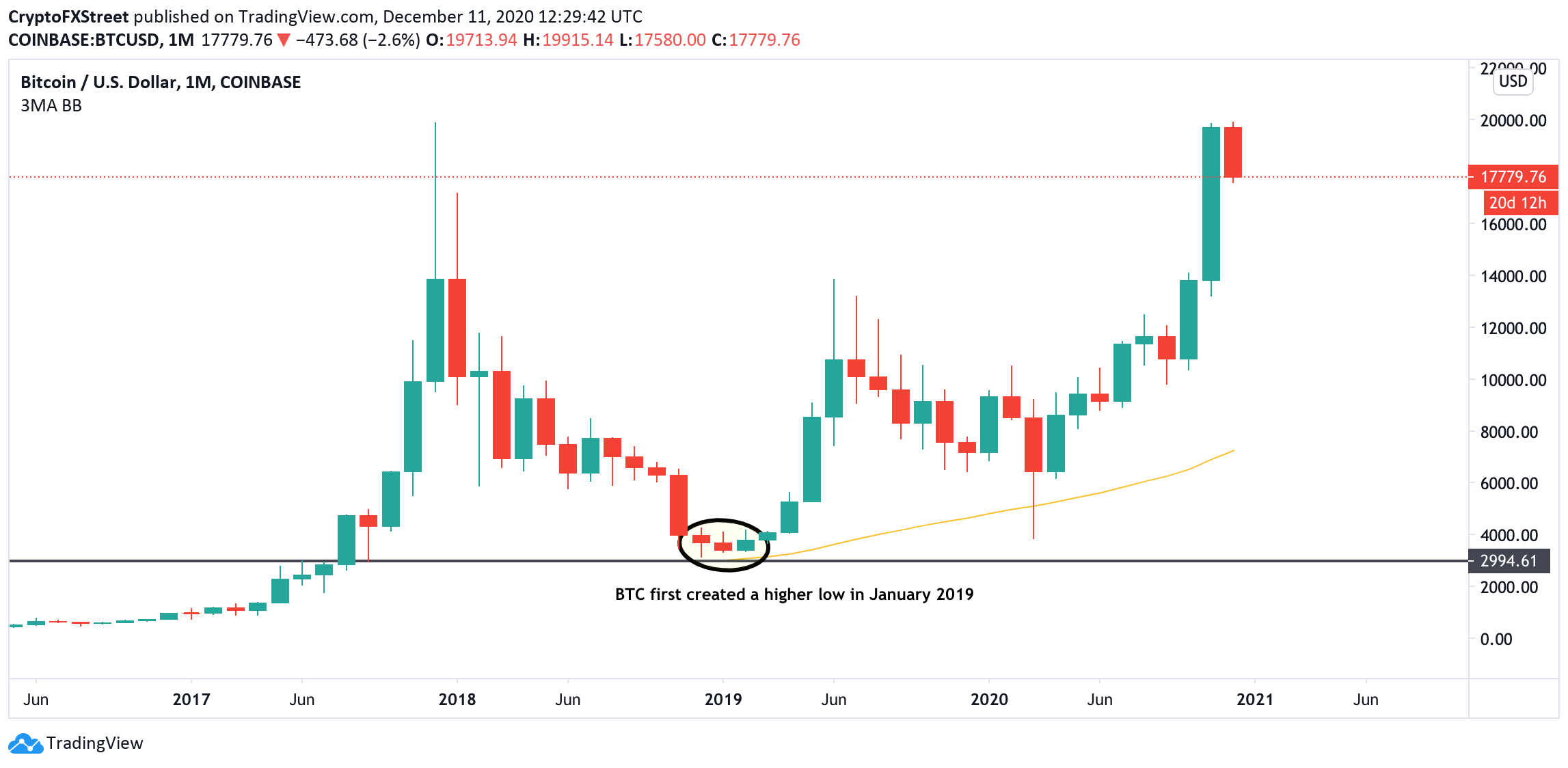

2. Identify trend reversal signals. This is necessary to detect the best entry point and capitalize on the movement. For example, rising monthly lows after a long-term bearish trend is a clear signal that the market is about to change the direction. However, traders often use several technical indicators to confirm or reject their theory.

For example, after a year-long sell-off, BTC touched a $3,128 low in December 2018 and created a first higher low on the monthly chart in January 2019. Meanwhile, the support coincided with monthly EMA50. Moreover, a move above this level in 2017 set the stage for the head-spinning rally towards $20,000. As a whole, these factors pointed out a major trend reversal.

BTC monthly chart

3. Identify the entry point. When the reversal is identified, swing traders zoom in to shorter time frames to look for an entry point. Usually, technical analysis is complemented with a fundamental background and overall market sentiment to get the bigger picture.

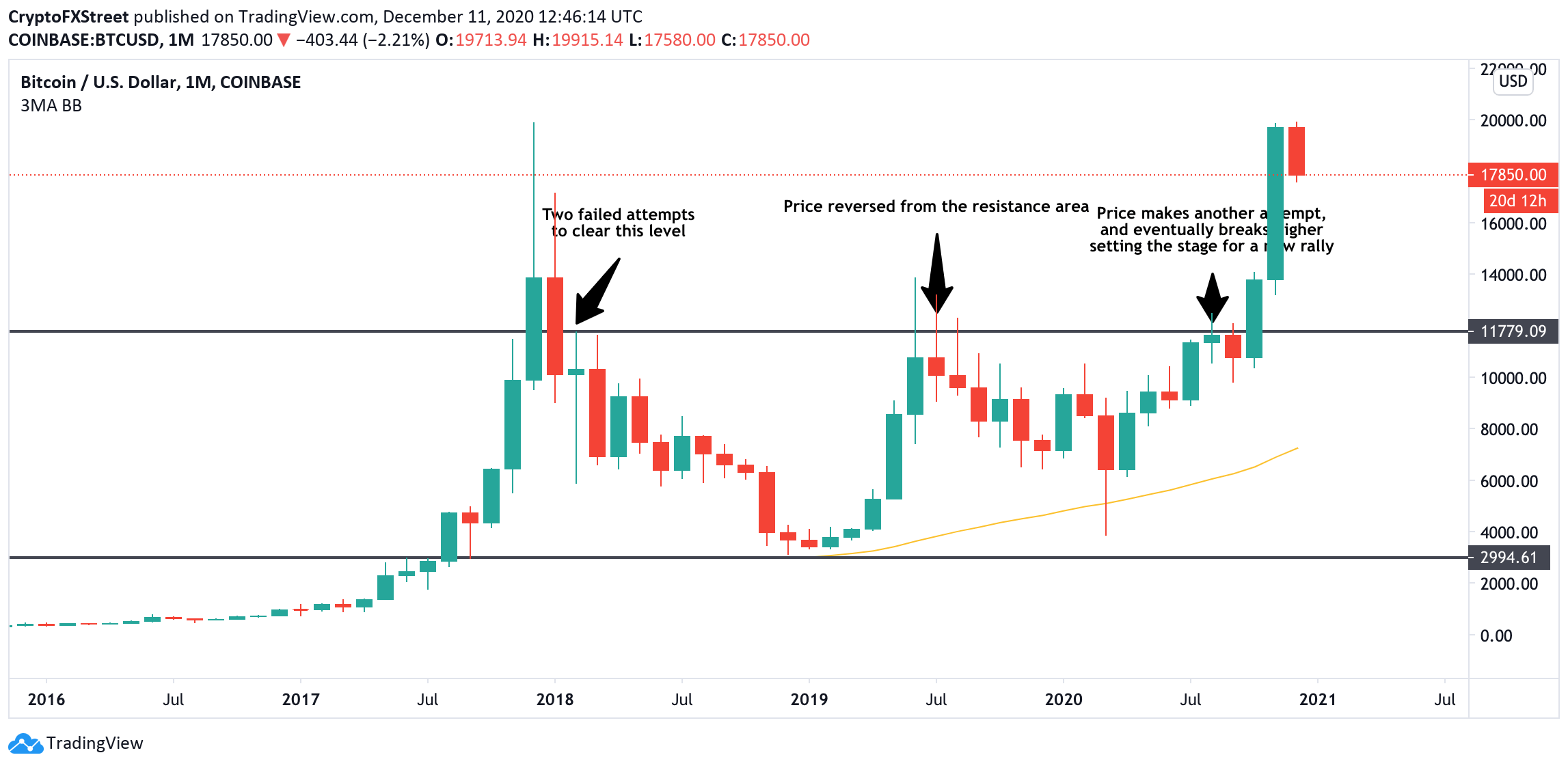

4. Identify targets and take profit levels. Swing traders usually think big and try to capitalize on large market swings. Support and resistance levels, as well as Fibonacci retracements and extension lines, help to define danger zones and to see when the market gets too close to them.

Traders either tale profit on approach to the resistance level or hold on and increase the position, depending on the other factors, like trading volume candlestick patterns and market sentiments.

BTC, monthly chart

5. Identify stop-loss. Stop-loss is a necessary order of any trading strategy as it allows managing risks and limits losses. In swing trading, the basic rules of the stop-loss are applied. It is generally recommended to limit the potential loss to 2-5% of the trade amount but at the end, traders decide where to place the stop based on their risk tolerance and the market conditions.

This strategy is a workable one that can be applied in the long-term and intraday time frames. It works best on trending markets and requires a though analysis and self-discipline. If everything is done right, a swing trader will earn more by trading less.