Idea of the Day

We’ve seen a marked turn-around on the single currency. Whilst it may appear that this came about from the better than expected CPI data released last week, there were several other factors at play, such as banks adjusting their balance sheets ahead of ECB stress tests and rising money market rates as banks continue to repay loans back to the ECB.

Nevertheless, it would still be a surprise to see the ECB cut interest rates this week. More likely is that we see some pre-announcement of further lending operations, designed stem the fall in excess liquidity in the Eurozone (cash in the system over and above what is required). This fall has helped the firmer tone to the euro so any action that causes a reversal would, other things equal, put downward pressure on the single currency.

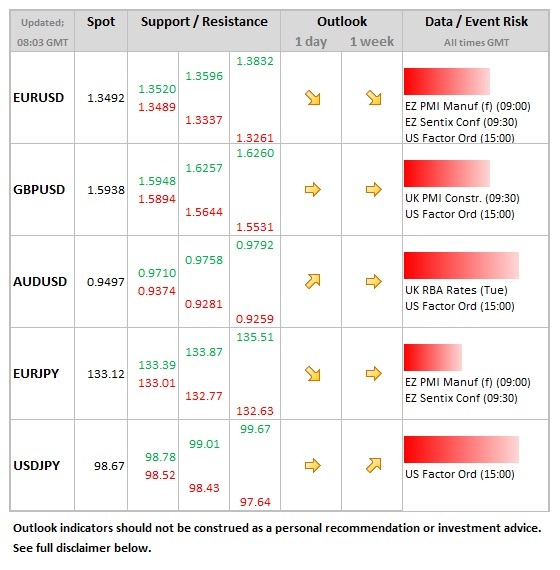

Data/Event Risks

GBP: Construction PMI data is seen slightly softer today, mirroring the correction lower seen in the manufacturing data over the past 2 months. Previous was 58.9. Sterling can be impacted if data materially differs versus expectations.

AUD: Aussie rates decision on Tuesday. No change expected, with language the main focus. They have moved to a more neutral stance over the past couple of months, which has been a factor supporting the currency over this time.

Latest FX News

JPY: A steady session in Asia, holding tight within the 98.60 to 98.80 level for the most part. USDJPY feeling a little less vulnerable having moved above the 200-day moving average which currently sits at 97.61.

EUR: Falling in the early part of the Asia session to a level last seen on 18th September (1.3442 low in Asia), but some recovery seen thereafter. Key focus is with the ECB meeting later in the week.

AUD: More strong data from the Aussie economy, with the latest sales data showing an 0.8% increase in headline sales for September. Data for house prices was in line, but did show the YoY rate rising from 5.1% to 7.6%. Aussie ending the Asia session above the 0.9500 level.

Further reading: