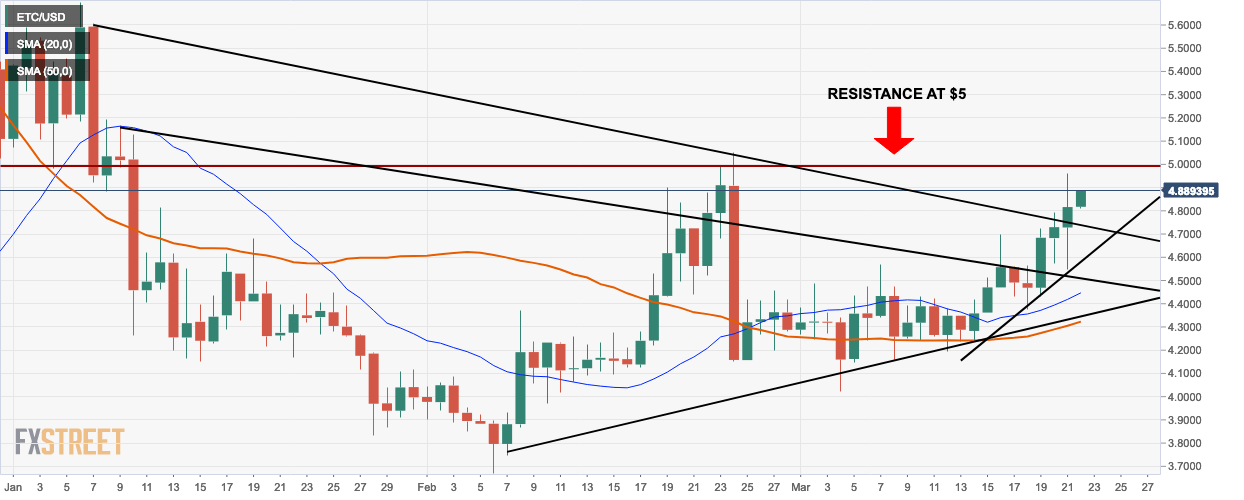

ETC/USD daily chart

- ETC/USD market opened at $4.89 this Friday.

- The bulls have taken control of the market four days in a row.

- Immediate resistance lies at $5.

- The price is trending above both the 20-day simple moving average (SMA 20) and SMA 50 curves.

ETC/USD 4-hour chart

- The 4-hour ETC/USD market is consolidating in a flag formation and is ready for a breakout.

- There was a notable crash four sessions ago, however, the bullish sentiment is so high, that not only did the market recover, but the Elliot wave remained in the bullish territory.

- According to the moving average convergence/divergence (MACD) histogram, the market momentum remains bullish.

ETC/USD hourly chart

- The ETC/USD hourly chart shows that there have been multiple times when the bears tried to take control of the market. There is a very notable flash crash as well.

- Each time, the bulls were able to thwart the bears and keep the overall sentiment bullish.

- The relative strength index (RSI) curve is trending between the neutral and overbought zone.

Key Levels

- Resistance3: $5.4136

- Resistance 2: $5.1866

- Resistance 1: $5.0014

- Pivot Point: $4.7744

- Support 1: $4.5892

- Support 2: $4.3622

- Support 3: $4.1770

-636888195202693077.png)

-636888195550412641.png)