- Ethereum Classic bullish momentum has legs at $7.2 – $7.4 support area.

- Technical analysis suggests the bulls are losing momentum especially with the retreating downwards.

Ethereum Classic rose significantly on Friday posting gains above 3%. The rise comes at the time the crypto market is sending mixed positive and negative signals. However, for Ethereum Classic, the current bullish correction has legs at $7.2 – $7.4 (buyer congestion zone).

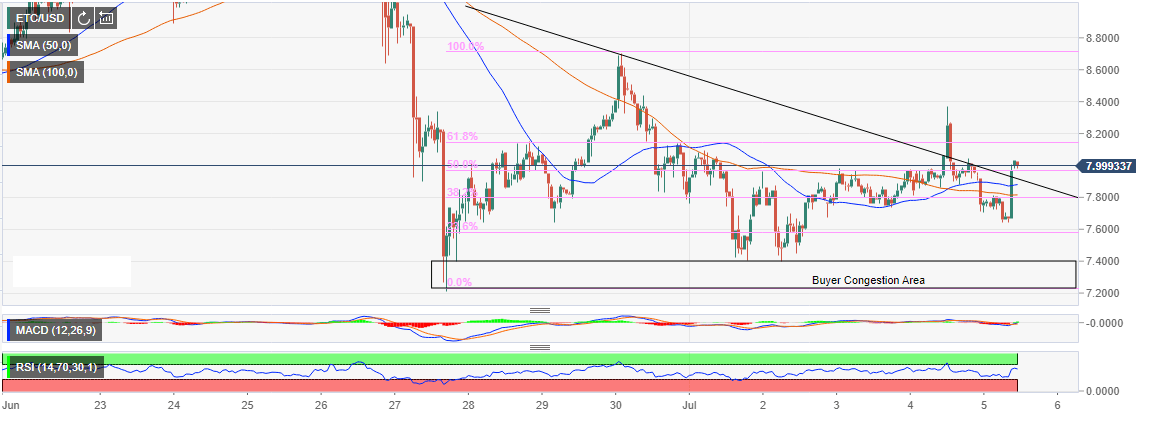

The declines towards the end of June dived below the 23.6% Fib retracement level taken between the last swing high at $8.7 to a swing low of $7.98. ETC/USD retested the support at $7.4 and defended the support at $7.2. Initial recovery yesterday zoomed above the 61.8% Fib level but the momentum fizzled out short of $8.4.

While there was a correction during the Asian trading hours on Friday, ETC/USD found bearing at $7.63 giving way for further correction that cleared the trendline resistance. At press time, Ethereum Classic is trading at $8.0 with the bulls fighting to hold on to the gains.

Technical analysis suggests the bulls are losing momentum especially with the Relative Strength Index (RSI) retreating before touching the oversold levels. The Moving Average Divergence Convergence cross into the positive region could market the beginning of correction towards the supply zone at $8.6.

ETC/USD 1-h chart