- A move above $190.00 is needed to mitigate the immediate bearish pressure.

- The significant support is created by a confluence of technical indicators below $185.00.

The second-largest cryptocurrency with the current market capitalization of $20.1 has been losing ground during early Asian hours. Ethereum has lost nearly 2.5% in recent 24 hours to trade at $185.70 at the time of writing. The coin is moving in lockstep with Bitcoin and other major altcoins, which means that it is vulnerable to further losses in the short-term.

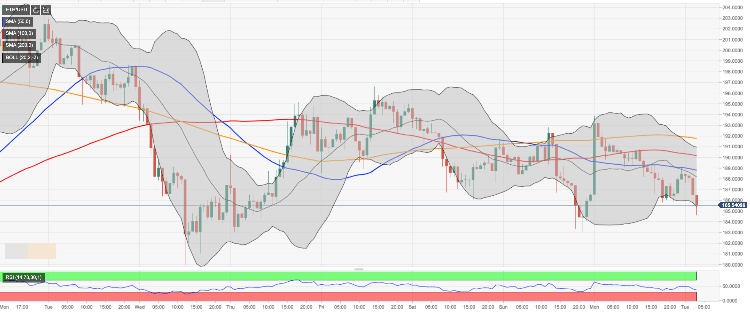

Ethereum’s technical picture

Looking technically, a swift recovery from the intraday low of $184.62 bodes well for short-term ETH bulls. However, the coin is still under strong pressure as long as it stays below psychological $190.00. This area is strengthened by SMA100 (Simple Moving Average) on the 1-hour chart, though we might have a hard time forcing the way towards the said resistance. A confluence of strong technical indicators including SMA50 1-hour and the middle line of 1-hour Bollinger Band at $188.00 might slow down the potential recovery.

On the downside, psychological $185.00 strengthened by the lower line of 4-hour Bollinger Band at serves as an initial support level that might limit downside correction for the time being. However, a sustainable move below this handle will open up the way towards the intraday low of $184.62 and to August 25 low of $182.96. Once it is out of the way, the sell-off is likely to gain traction with the next focus on psychological $180.00.