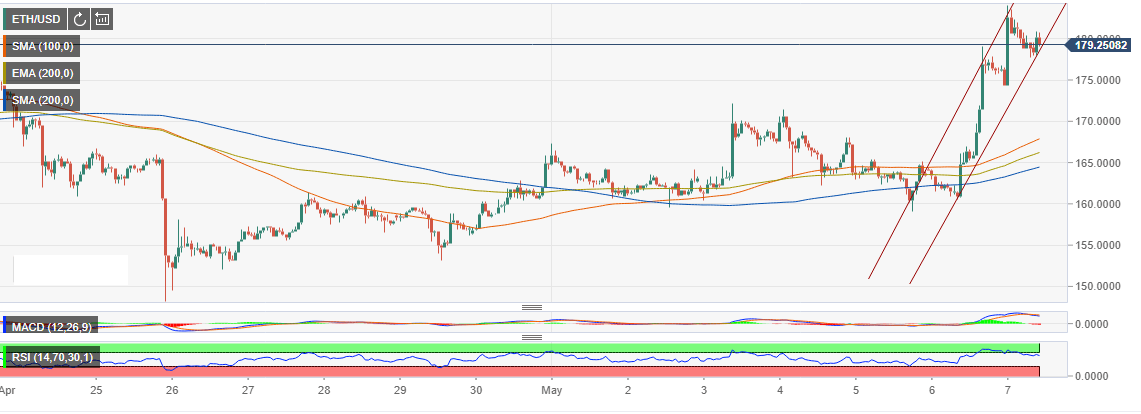

- Intraday charts for ETH/USD trading pair trending upwards 2.94%.

- A building bullish momentum could recover above $180 while the bulls still focus on $200.

Ethereum 9.15% rise comes after positive news from the Commodity Futures Trading Commission (CFTC) on May 6. The daily trading volume rose incredibly from $5.9 billion on May 5 to $7.5 billion on May 6. The volume has continued to increase and stands at 48.8 billion in the last 24 hours. The market cap has also grown significantly from $17.3 billion to $18.8 billion in the same period.

Meanwhile, we see the intraday charts for ETH/USD trading pair trending upwards 2.94%. Since the last week of April, the price consolidated above $160 (support congestion) while the upside stayed limited at $170. However, the news on ETH futures revived investor interest in the crypto as the price corrected upwards above the 100 SMA 1-hour and later break above $170. Continued bullish pressure within an ascending channel zoomed above $180 but came short of $185 forming a high at $184.08.

For now, Ethereum is trading at $179.29 after a slight retracement. The 15-minutes chart shows the price has broken above a short-term bullish flag pattern after finding support at $177.78. A building bullish momentum could recover above $180 while the bulls still focus on $200 in the short-term. Other support areas are $175, $170 as well as $160.

ETH/USD 1-hour chart

The CFTC according to CoinDesk is ready to consider Ethereum futures contracts. The report cited an anonymous source who said:

“I think we can get comfortable with an ether derivative being under our jurisdiction. We don’t do bold pronouncements, what we do is we look at applications before us.”

It is believed that a futures contract for Ethereum will spike fresh interest and demand for the coin just like what happened on Both CME and CBOE back in December 2017.