- As more fundamental factors continue to affirm that Ethereum is underpriced, hopes for new highs remain intact.

- While technical indicators may reflect indecision in price direction, the bullish thesis for Ether continues to build up.

The increasing demand from institutional investors for Ethereum continues to build a compelling argument for its bullish outlook. Taking into consideration ETH 2.0’s launch, it seems to be only a matter of time before ETH price begins to react accordingly.

Ethereum price awaits an impending breakout

Another perspective reinforcing Ethereum’s bullish narrative is that Bitcoin currently trades at levels close to its previous all-time high, whereas the smart contracts token sits 50% below its 2017 peak. The correlation seen between both digital assets, with the latter always lagging behind, implies that it has more room to go up.

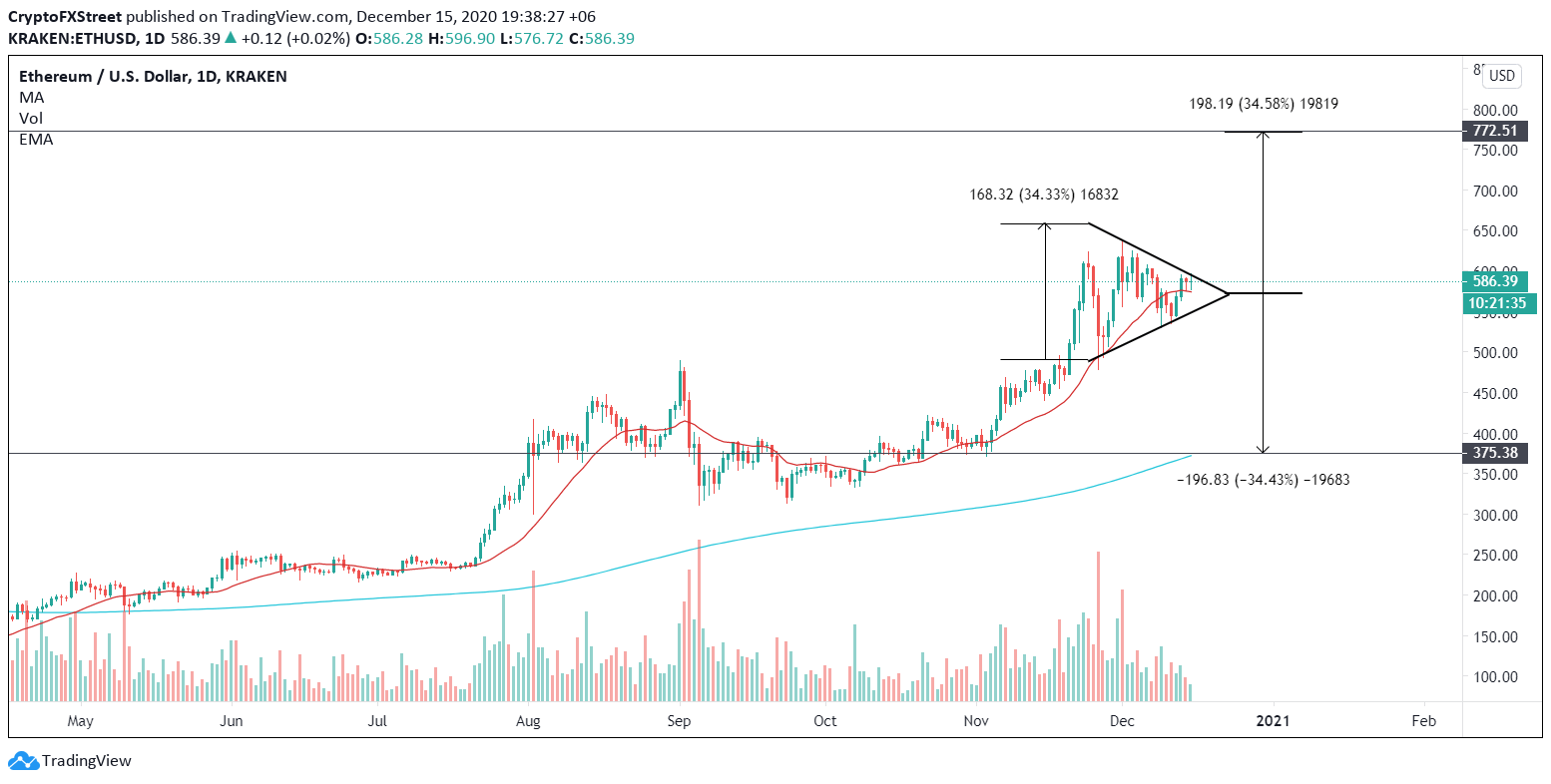

ETH’s daily chart reveals indecision among market participants. The ongoing stagnation period led to the formation of a symmetrical triangle. Breaking out of this technical pattern will see Ether price move by nearly 35%.

On the upside, the second-largest cryptocurrency by market capitalization could target $800.

ETH/USD daily chart

But if selling pressure mounts, Ethereum may slip below the $550 support level and aim for $375. Slicing through the triangle’s lower boundary could be beneficial for ETH’s uptrend as sidelined investors will have an opportunity to get back in the market.

A significant spike in buy pressure around the $400 support zone may be the catalyst that pushes Ethereum price towards $840, corresponding to May’s resistance region, and subsequently $1,200.