- Ethereum has lost all weekly gains.

- Sell-off may take the coin below $160 to 50.% Fibo.

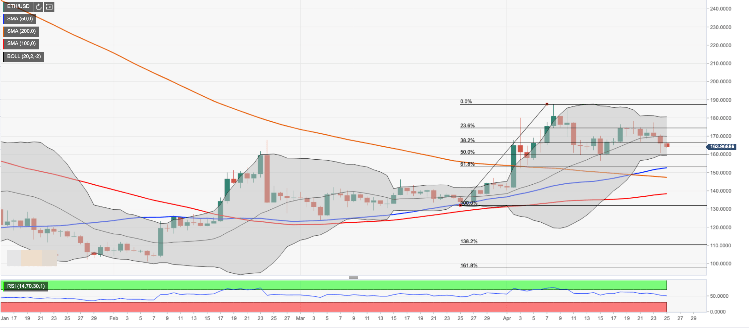

Ethereum dropped to $160.87 on Wednesday. This is the lowest level since April 16. While second largest cryptocurrency with the current market value of $17.3 billion managed to regain some ground to trade at $164.00 by the time of writing, it is still nearly 4% lower from this time on Wednesday. Moreover, ETH/USD has lost over 4% of its value on a week-on-week basis, reversing the gains of the previous week.

At this stage, ETH recovery is capped by 38.2% Fibo retracement for the upside move from March 25 low. A sustainable move higher is needed to negate the immediate bearish pressure and proceed to the next bulls’ aim at $170.00 propped by the middle line of daily Bollinger Band.

On the downside, a confluence of 50% Fibo retracement and the lower line of a daily Bollinger Band creates a strong support that is likely to stop the sell-off and initiate a recovery. However, once it is broken, the downside momentum will gain traction with $153.20 (61.8% Fibo retracement) next in the line, followed by $152.60 (DMA50).

ETH/USD, the daily chart