- Ethereum returned to $284 after a sudden drop below $240.

- Tom Lee explains why futures are a terrible thing for ETH.

ETH/USD is trading at $284 after an unexpected but short-lived drop to $237 low during early Asian hours. The “flash crash” happened on Kraken exchange at 3:55 GMT and was reversed within minutes. Considering that the drop was accompanied by a volume increase, it might have been caused by a significant transaction, though there is no clear confirmation to that effect as of yet.

Ethereum’s capitalization is registered at $29.4B, while an average daily trading volume is set at $1.2B. The coin is down 1% on a daily basis and mostly unchanged since the beginning of Tuesday.

Fundstrat’s co-founder Tom Lee believes that Ethereum futures will lead to ETH price decline and support its main rival Bitcoin. According to Business Insider, Lee draws a parallel between Bitcoin’s futures launch in December 2017. The event was followed by a substantial BTC price crash that resulted in 70% losses from December highs. Tom Lee believes that Ethereum will follow the same pattern because futures will attract bears and speculative traders focused on cryptocurrency price decrease.

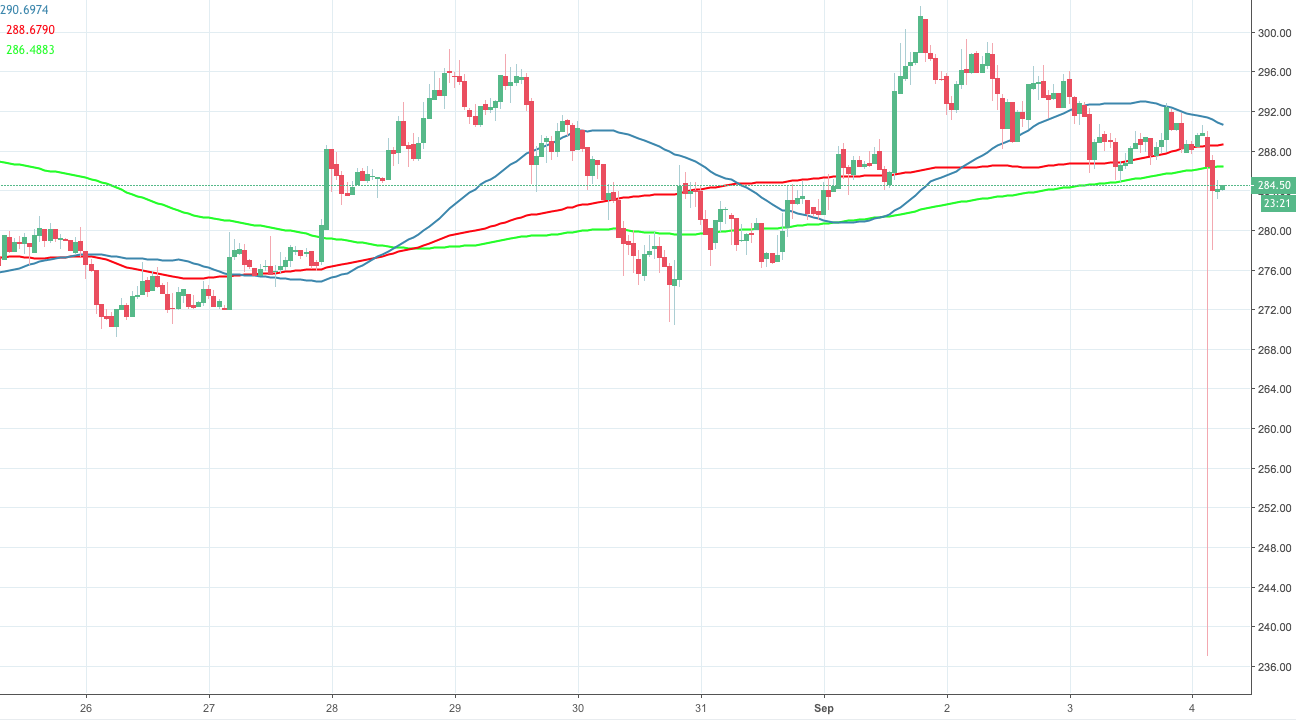

Ethereum’s technical picture

ETH/USD stays below SMA50, SMA100 and SMA200 (one hour chart) with the ultimate short-term resistance registered at $290. Once it is cleared, the focus will shift onto $300, which remains unattainable altitude, guarded by 61.8% Fibo retracement daily and 23.6% Fibo retracement monthly. On the downside, the support is created by $280, followed by $258 (August 22).

ETH/USD, 1-hour chart