- The recovery trend tested the key resistance at $480, but instead, it lost momentum.

- Ethereum transactions back to normal above 700,000 from the 450,000 recorded on July 15.

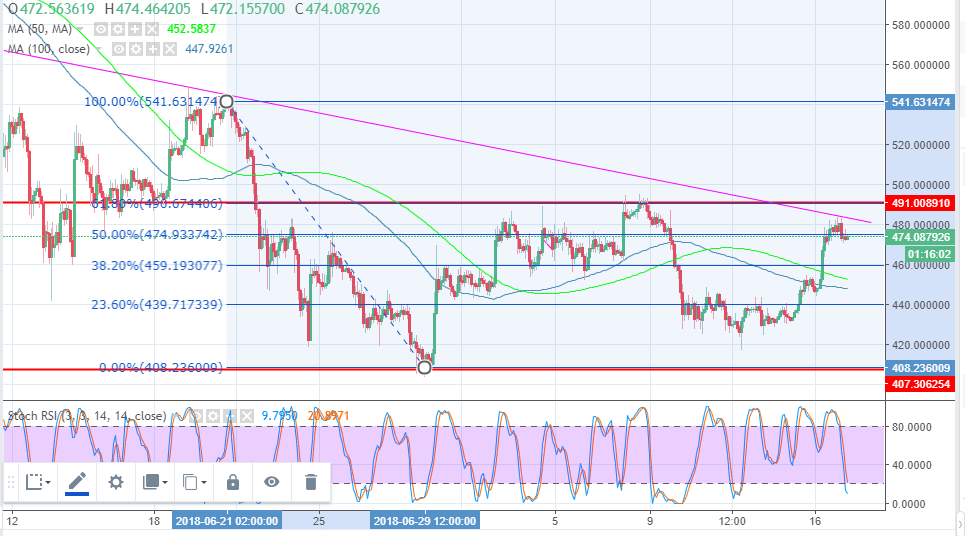

Ethereum price appears to have escaped one range below $460 only to find itself trapped in another range with an upper limit of $491.00. The past three weeks have seen Ethereum test the waters downstream almost hitting rock-bottom at $400. However, the recovery in the first week of July was capped at $490. Consequently, the current bullish trend, initiated on Monday 16 has also run into another cap at $480 after recovering from the pits slightly above the support at $420.

At the time of writing, ETH/USD is battling to shake off the selling activity at the 61.8% Fib retracement level with the last swing high of $547.6 and a low of $408.23 close to $474. The recovery trend tested the key resistance at $480, but instead, it lost momentum. Ethereum is supported short-termly at $470 as the buyers fight to break out of the restrictive ranging channel. While the moving averages gap is reducing, hence sending bullish signals, the Stochastic RSI on the 1-hour chart is sending bearish signals. It is clearly a battle for the fittest between and the buyers.

In other news, the Ethereum network had witnessed a drop in the number of transactions. Significantly, the transactions have, however, come back to normal above 700,000 from the 450,000 transactions recorded on July 15. At the same time, the fees on the network have gone down tremendously to just three cents.