- ETH is under pressure due to worsened market sentiments.

- The intraday technical picture implies further sell-off.

Ethereum, the third largest digital asset, is changing hands at $116.33 with a bearish bias. The coin has lost over 2% of its value on a day-over-day basis and became one of the worst-performing cryptocurrencies out of top-10.

Fundamentally, Constantinople delay increased pressure on the coin; However, the adverse effect is fading away, leaving the coin at the mercy of technical and speculative factors.

CBOE’s decision to withdraw the request for rules change has not triggered a massive market reaction, but it does not help improve the sentiments anyway.

Ethereum’s technical picture

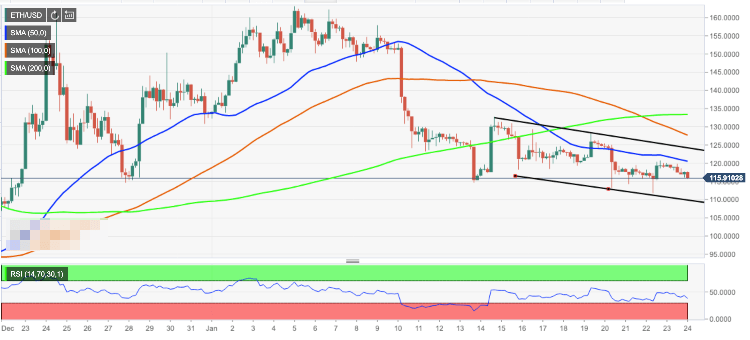

On the intraday level, ETH/USD is moving in the middle of a downside channel limited by $124.26 on the upside and $108.67 on the downside. Considering the downward bias of the Relative Strength Index (RSI), the risks are skewed to the downside. Once the above-said channel support is broken, the sell-off will gather pace with the next aim as low as $100.

On the upside, the first barrier is created by psychological $120.00 and closely followed by SMA50 (4-hour) at $120.54. A sustainable move higher will expose the channel resistance.

ETH/USD, 4-hour chart