- Ethereum smashes several lifesaving support to trade below $200 for the first time in October.

- ETH/USD struggles to make headway above $200; easiest path is to the south.

The cryptocurrency market has turned bearish on Thursday following two weeks of consolidation. The sudden drop has not been explained while a research firm says that Bitcoin whales are not entirely behind the up and down swings in the market. The research was released by Chainalysis and took into account the activities of 32 biggest Bitcoin wallets. The research firm dived into the investigation following an article by Bloomberg which insinuated that a Bitcoin Whale sent the market tumbling while Bitcoin dropped 15%. However, the results of the research show that the claims were unfounded.

More on this story to come in the next article.

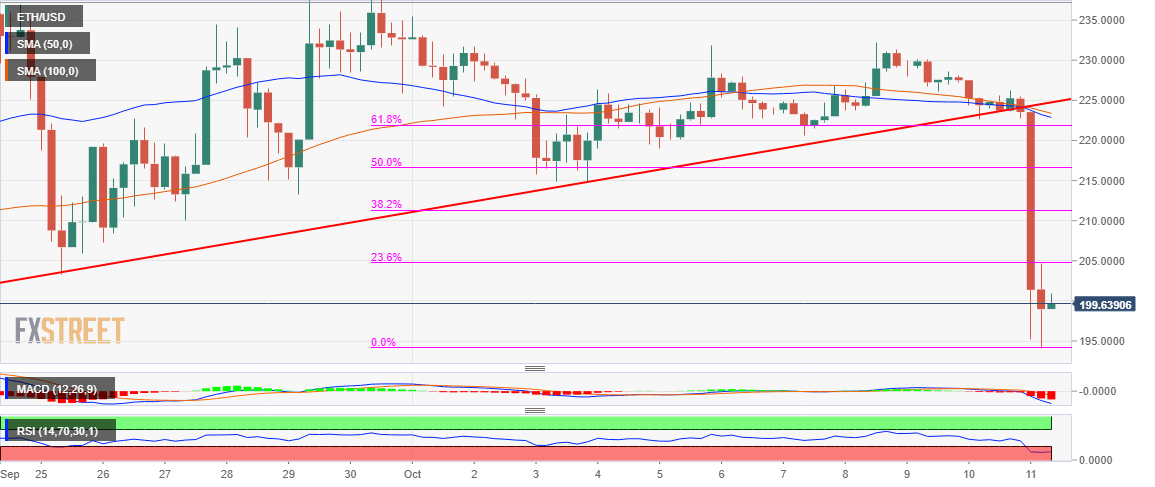

Prior to today’s overarching fall, Ethereum was stable above $220. In fact, it has been hammering at the resistance level at $230 since this week started. The buyers had eyes on $250, a level that would open the door for gains towards $300 and beyond. The declines have not only broken the support at $220, they have smashed a couple of other lifesaving support zones at $205 and $200 respectively. ETH/USD also tested the nest support at $195 before the ongoing weak recovery began.

Ethereum price is currently dancing with $200 while the bulls are pushing for a pull back above the next broke support at $200. Looking at the chart, TH/USD is likely to correct lower towards $190 as opposed to making headway above $200. This is because the indicators like the RSI and the MACD keep sending negative signals.